The Utah lodging market presents opportunities for acquiring established businesses. These opportunities encompass a range of property types, from smaller, independent motels to larger, branded hotels, catering to diverse traveler demographics and investment strategies. For example, a boutique hotel in a ski resort town presents a different investment profile than a roadside motel catering to budget travelers.

Acquiring an existing hotel in Utah offers several potential advantages. These can include immediate revenue generation from established operations, a pre-existing customer base, and a trained workforce already in place. Furthermore, the state’s diverse tourism economy, encompassing national parks, ski resorts, and convention centers, provides a relatively stable market. Historically, Utah’s hospitality industry has demonstrated resilience and growth, making it an attractive location for investors.

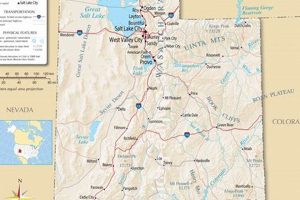

This article will delve into the key aspects of the Utah hotel market, including market trends, financing options, due diligence considerations, and legal requirements. It will also explore the various regions within the state and their unique characteristics relevant to prospective hotel investors.

Careful consideration of several factors is recommended when exploring the acquisition of a hotel property in Utah. These tips offer guidance for potential investors.

Tip 1: Market Research: Conduct thorough research on Utah’s diverse tourism regions. Understand the target demographics, seasonal fluctuations, and competitive landscape within the specific area of interest. For example, a hotel near Zion National Park will experience different demand patterns than a property in Salt Lake City.

Tip 2: Property Evaluation: Engage qualified professionals to conduct thorough inspections and assessments of the physical property, including infrastructure, compliance with regulations, and potential renovation needs.

Tip 3: Financial Analysis: Develop a realistic financial model that incorporates revenue projections, operating expenses, financing costs, and potential return on investment. Consider current market conditions and historical performance data.

Tip 4: Legal Counsel: Secure legal representation experienced in hospitality real estate transactions to navigate the complexities of contracts, due diligence, and regulatory compliance.

Tip 5: Local Expertise: Consult with local experts, including real estate agents specializing in hospitality properties and business brokers familiar with the Utah market. This can provide valuable insights into local market dynamics.

Tip 6: Financing Options: Explore various financing options, including traditional bank loans, private equity, and Small Business Administration (SBA) loans. Compare terms and conditions to identify the most suitable financing structure.

Tip 7: Due Diligence: Conduct comprehensive due diligence to verify all information provided by the seller, including financial records, occupancy rates, and existing contracts.

By carefully considering these factors, prospective hotel investors can make informed decisions and mitigate potential risks. Thorough preparation and professional guidance are crucial for successful acquisition and operation.

The following section will provide a concluding overview of the opportunities and challenges present in the Utah hotel market.

1. Property Location

Property location significantly influences the potential success of hotel investments in Utah. Careful consideration of geographic factors, market dynamics, and accessibility is crucial for informed decision-making. The following facets highlight the importance of property location within the context of Utah hotels for sale.

- Proximity to Demand Generators

Hotels situated near major demand generators, such as national parks, ski resorts, convention centers, or business districts, typically experience higher occupancy rates and revenue potential. A hotel near Zion National Park, for example, benefits from consistent tourist traffic, while a property in downtown Salt Lake City attracts business travelers. Understanding the primary demand drivers for a specific location is essential for evaluating investment viability.

- Accessibility and Transportation

Easy access to major highways, airports, and public transportation networks enhances a hotel’s appeal to travelers. Properties with convenient access points are more likely to attract both leisure and business guests. A hotel near the Salt Lake City International Airport, for instance, holds a competitive advantage over a more remote property. Evaluating transportation infrastructure is critical for assessing a property’s desirability.

- Local Market Dynamics

Understanding the local market, including competition, existing hotel supply, and prevailing room rates, is crucial. A thorough market analysis helps determine the potential for success in a particular location. For example, a market saturated with similar hotels might present challenges for a new entrant. Analyzing market dynamics provides insights into potential risks and opportunities.

- Future Development and Infrastructure

Planned developments, infrastructure projects, and zoning regulations can significantly impact a hotel’s long-term value. A hotel near a planned highway expansion, for instance, could experience increased accessibility and demand. Considering future development projects provides a forward-looking perspective on investment potential.

Strategic property location is fundamental to a successful hotel investment in Utah. By carefully analyzing demand generators, accessibility, market dynamics, and future development, investors can identify properties with the highest potential for profitability and long-term value appreciation. A comprehensive understanding of these factors is essential for navigating the Utah hotel market effectively.

2. Hotel Size & Type

Hotel size and type significantly influence investment strategies, target demographics, and operational complexities within the Utah hotel market. Understanding the nuances of various hotel classifications is crucial for prospective buyers. This exploration delves into the relationship between hotel size and type and their implications for those seeking “utah hotels for sale.”

- Boutique Hotels

Boutique hotels, typically smaller properties with unique design and personalized service, cater to a specific niche market. In Utah, these might cater to luxury travelers seeking curated experiences, often found in destinations like Park City or Moab. Their acquisition requires understanding the target demographic and the operational demands of delivering high-touch service. The investment profile of a boutique hotel differs significantly from that of a larger, chain-affiliated property.

- Limited-Service Hotels

Limited-service hotels, often mid-sized properties offering essential amenities without extensive dining or meeting facilities, frequently cater to budget-conscious travelers or shorter stays. These establishments can be viable investment opportunities in high-traffic areas of Utah, such as highway corridors or near popular attractions. Operational efficiency and cost management are key factors for success in this segment.

- Full-Service Hotels

Full-service hotels, larger establishments offering a comprehensive range of amenities, including multiple dining options, meeting spaces, and recreational facilities, often target both business and leisure travelers. These properties require significant investment and operational expertise, often appealing to institutional investors or experienced hotel operators. Location within major urban centers or resort areas is crucial for attracting the desired clientele in Utah.

- Extended-Stay Hotels

Extended-stay hotels cater to travelers requiring longer-term accommodations, offering amenities like kitchenettes and in-suite laundry facilities. These properties can be attractive investments in areas with strong corporate presence or project-based employment, such as those supporting Utah’s growing tech sector. Understanding the specific needs of long-term guests is essential for successful operation in this segment.

Careful consideration of hotel size and type is essential when evaluating properties within the “utah hotels for sale” landscape. Each category presents unique operational requirements, target markets, and investment profiles. Aligning these factors with individual investment goals and risk tolerance is critical for successful acquisition and operation within the dynamic Utah hospitality market. Further research into specific market segments and local demand drivers is recommended for prospective buyers.

3. Market Analysis

Market analysis forms the bedrock of informed investment decisions regarding Utah hotels for sale. A comprehensive understanding of market dynamics, including supply and demand factors, competitive landscape, and economic trends, is crucial for evaluating potential risks and opportunities. Analyzing occupancy rates, average daily rates (ADR), and revenue per available room (RevPAR) of comparable properties provides benchmarks for assessing financial performance potential. For instance, a market analysis might reveal an undersupply of luxury hotels in a specific region, suggesting a potential opportunity for a new boutique hotel. Conversely, a market saturated with budget motels might present challenges for new entrants in that segment.

Furthermore, analyzing demographic trends, tourism patterns, and economic forecasts informs projections of future demand. For example, a growing tech sector in a particular city might indicate increased demand for extended-stay hotels catering to business travelers. Understanding the seasonality of tourism in destinations like Park City, driven by ski season, helps investors anticipate fluctuations in occupancy and revenue. Market analysis also encompasses understanding the regulatory environment, including zoning regulations and licensing requirements, which can impact development and operational costs. This comprehensive approach minimizes investment risks and maximizes the likelihood of successful acquisition and operation.

In conclusion, robust market analysis is an indispensable component of due diligence when considering Utah hotels for sale. It provides a data-driven foundation for evaluating investment potential, mitigating risks, and developing effective operational strategies. Ignoring this critical step can lead to flawed investment decisions and diminished returns. The insights derived from thorough market analysis inform every stage of the acquisition process, from property valuation to financing decisions and long-term operational planning. Ultimately, a comprehensive understanding of the market dynamics underpins successful hotel investments in Utah’s competitive hospitality landscape.

4. Financial Performance

Financial performance serves as a critical evaluation metric for Utah hotels for sale, providing prospective buyers with insights into profitability, operational efficiency, and investment potential. Analyzing historical financial data, understanding revenue streams, and evaluating expense structures are essential components of due diligence. A thorough assessment of financial performance allows investors to make informed decisions aligned with their investment objectives and risk tolerance.

- Revenue Generation

Evaluating revenue generation involves analyzing key performance indicators (KPIs) such as occupancy rates, average daily rates (ADR), and revenue per available room (RevPAR). Examining historical trends, seasonal fluctuations, and market comparisons provides insights into a hotel’s revenue-generating capacity. For example, a hotel with consistently high occupancy and ADR in a competitive market suggests strong revenue performance. Understanding revenue drivers, such as room sales, food and beverage operations, and other ancillary services, helps assess the overall financial health of the property.

- Expense Management

Analyzing operating expenses, including labor costs, utilities, maintenance, and marketing expenses, is crucial for understanding profitability. Efficient expense management contributes directly to a hotel’s bottom line. Comparing expense ratios to industry benchmarks allows investors to identify potential areas for improvement or cost optimization. For instance, a hotel with unusually high labor costs compared to similar properties might warrant further investigation into operational efficiency.

- Profitability Analysis

Assessing profitability involves examining net operating income (NOI), profit margins, and return on investment (ROI). Understanding historical profitability trends and projecting future performance based on market conditions and operational strategies are crucial for investment decisions. A hotel with consistently strong NOI and healthy profit margins indicates a viable investment opportunity. Analyzing profitability metrics helps investors determine the financial viability and potential return on their investment.

- Debt Service Coverage Ratio (DSCR)

DSCR measures a property’s ability to generate sufficient cash flow to cover its debt obligations. Lenders often require a minimum DSCR to assess the financial stability and risk associated with financing a hotel acquisition. A healthy DSCR indicates a lower risk of default and demonstrates the property’s capacity to meet its financial obligations. This metric is particularly relevant for investors seeking financing for their purchase.

In conclusion, evaluating the financial performance of Utah hotels for sale is paramount for informed investment decisions. Analyzing revenue generation, expense management, profitability, and debt service coverage provides a comprehensive understanding of a property’s financial health and potential for future success. Thorough financial due diligence minimizes risks and allows investors to identify properties aligned with their investment goals and financial expectations within the dynamic Utah hospitality market.

5. Legal Due Diligence

Legal due diligence constitutes a critical component when considering Utah hotels for sale. It mitigates potential legal risks associated with property acquisition by thoroughly examining all relevant legal documentation and ensuring compliance with applicable laws and regulations. This process safeguards investors from unforeseen legal liabilities and ensures a smooth transaction. Failure to conduct adequate legal due diligence can result in significant financial losses and legal disputes, potentially jeopardizing the entire investment. For example, undisclosed environmental liabilities or unresolved title issues can lead to substantial remediation costs or legal challenges post-acquisition. A real-life example might involve a hotel with unresolved zoning permits for an expansion project, impacting the buyer’s ability to execute planned improvements and potentially affecting the property’s value.

Key aspects of legal due diligence for Utah hotels include reviewing title reports to confirm clear ownership and identify any encumbrances, such as liens or easements. Analyzing existing contracts, including leases, vendor agreements, and employment contracts, ensures a clear understanding of ongoing obligations and potential liabilities. Verifying compliance with building codes, fire safety regulations, and accessibility requirements protects against future legal and operational challenges. Furthermore, examining environmental reports assesses potential environmental contamination liabilities, crucial in Utah’s diverse landscape, ranging from urban centers to ecologically sensitive areas. For example, a hotel situated near a protected watershed requires careful scrutiny of environmental compliance to mitigate potential risks.

In summary, robust legal due diligence is an indispensable element in the acquisition process for Utah hotels for sale. It protects investors from unforeseen legal and financial liabilities, ensuring a secure and informed investment decision. Negligence in this critical area can have severe consequences, potentially jeopardizing the entire investment. Thorough legal due diligence provides peace of mind and establishes a solid legal foundation for successful hotel ownership and operation in Utah. It directly impacts the long-term viability and profitability of the investment, making it an essential component of any prudent acquisition strategy in the Utah hotel market.

6. Operational Strategy

Operational strategy plays a crucial role in the valuation and successful operation of Utah hotels for sale. A well-defined operational strategy directly impacts a hotel’s profitability, market positioning, and long-term sustainability. This strategy encompasses various key aspects, including revenue management, cost control, customer service, and staff management. Effective revenue management strategies, such as dynamic pricing and targeted marketing campaigns, maximize revenue generation by optimizing occupancy and average daily rates. For example, a hotel near a ski resort might implement higher rates during peak season and offer discounted packages during the off-season to attract a consistent flow of guests. A clear understanding of the target market and competitive landscape informs effective revenue management practices.

Cost control measures, including efficient staffing, energy conservation, and streamlined procurement processes, contribute significantly to a hotel’s bottom line. Implementing sustainable practices, such as reducing water and energy consumption, not only lowers operational costs but also aligns with the growing demand for eco-conscious travel, attracting environmentally conscious guests. For instance, a hotel might invest in energy-efficient lighting and appliances to reduce utility expenses while simultaneously promoting its commitment to sustainability. Furthermore, effective staff management, including training, motivation, and retention programs, fosters a positive work environment, leading to improved customer service and operational efficiency. A well-trained and motivated staff enhances guest satisfaction and loyalty, contributing to positive online reviews and repeat business, ultimately impacting a hotel’s reputation and profitability.

In conclusion, a robust operational strategy is essential for maximizing the value and ensuring the long-term success of Utah hotels for sale. Prospective buyers must carefully evaluate existing operational strategies and identify opportunities for improvement or innovation. A well-defined operational strategy, encompassing effective revenue management, cost control, customer service, and staff management practices, directly impacts a hotel’s profitability and market competitiveness. Understanding the interplay of these factors is crucial for making informed investment decisions and navigating the dynamic hospitality landscape in Utah. Due diligence in assessing the operational aspects of a hotel is as critical as evaluating its financial performance and legal standing. A comprehensive understanding of the operational landscape ensures a smooth transition of ownership and positions the hotel for continued success in the competitive Utah market.

7. Investment Goals

Investment goals serve as the compass guiding decisions within the Utah hotel market. Clarity of purpose is paramount before evaluating properties. Differing investment objectives necessitate distinct approaches to property selection, due diligence, and operational strategies. For instance, an investor seeking short-term gains through property flipping prioritizes properties with immediate value-add potential, while a long-term investor focused on stable cash flow prioritizes established properties with consistent performance. A real-life example might involve an investor seeking to capitalize on Utah’s burgeoning tech sector by acquiring an extended-stay hotel near a tech hub, anticipating increased demand from business travelers. Conversely, an investor interested in leveraging Utah’s tourism industry might target a boutique hotel near a national park, aiming to attract leisure travelers seeking unique experiences. The alignment of investment goals with property selection is fundamental to successful outcomes.

Furthermore, investment goals influence financing strategies and risk tolerance. Investors seeking rapid returns might opt for higher leverage, accepting increased risk, while those prioritizing long-term stability might favor lower leverage and more conservative financing options. Understanding the interplay between investment goals and financial structuring is essential for maximizing returns and mitigating potential risks. For example, an investor with a high-risk tolerance might pursue a value-add strategy, acquiring a distressed property, renovating it, and then selling it for a profit. This approach carries higher risk but offers the potential for significant returns. Conversely, an investor with a lower risk tolerance might prefer acquiring a stabilized property with predictable cash flow, even if it means lower potential returns. The interplay between investment goals and risk assessment shapes investment strategies and influences decision-making throughout the acquisition process.

In conclusion, clearly defined investment goals are indispensable for successful navigation of the Utah hotel market. These goals dictate property selection criteria, influence financial structuring, and shape operational strategies. Aligning investment goals with market realities and conducting thorough due diligence based on these goals are essential for maximizing returns and mitigating risks. The practical significance of understanding this connection lies in the ability to make informed decisions, avoid costly mistakes, and achieve desired investment outcomes in Utah’s dynamic hospitality landscape. A clear understanding of investment objectives serves as the foundation for effective decision-making throughout the investment lifecycle, from initial property identification to long-term operational management.

Frequently Asked Questions

This section addresses common inquiries regarding the acquisition of hotels in Utah, providing concise and informative responses for prospective investors.

Question 1: What are the typical price ranges for hotels currently available in Utah?

Hotel prices in Utah vary significantly based on factors such as location, size, type, condition, and revenue performance. Smaller, limited-service properties might be available in the lower millions, while larger, full-service hotels in prime locations can command prices in the tens of millions or higher. Thorough market analysis and property valuations are essential for determining a fair market price.

Question 2: What financing options are available for acquiring hotels in Utah?

Various financing options exist, including traditional bank loans, Small Business Administration (SBA) loans, private equity investments, and joint ventures. The most suitable financing structure depends on the investor’s financial position, risk tolerance, and the specifics of the target property. Consulting with financial advisors specializing in hospitality real estate is recommended.

Question 3: What due diligence is recommended when considering a hotel purchase in Utah?

Thorough due diligence is critical. This includes a comprehensive review of financial records, property inspections, title searches, environmental assessments, and legal reviews of contracts and permits. Engaging qualified professionals, such as real estate attorneys, accountants, and hospitality consultants, is essential for a comprehensive assessment.

Question 4: What are the key regulatory considerations for operating a hotel in Utah?

Hotel operators in Utah must comply with various regulations, including licensing requirements, building codes, fire safety regulations, health and sanitation standards, and accessibility guidelines. Consulting with legal counsel specializing in hospitality law is advisable to ensure full compliance and avoid potential legal issues.

Question 5: What are the primary demand drivers for Utah’s hotel market?

Utah’s diverse economy, encompassing tourism, outdoor recreation, business travel, and conventions, drives demand for hotel accommodations. National parks, ski resorts, and business centers contribute significantly to occupancy rates. Understanding these demand drivers is essential for market analysis and revenue projections.

Question 6: What are the potential risks and challenges associated with investing in Utah hotels?

Potential risks include economic downturns, fluctuations in tourism, increased competition, rising operating costs, and unforeseen events such as natural disasters. Thorough market analysis, risk assessment, and contingency planning are essential for mitigating these risks and ensuring long-term viability.

Careful consideration of these frequently asked questions provides a foundational understanding of the key aspects involved in acquiring and operating a hotel in Utah. Further research and consultation with industry professionals are recommended for informed decision-making.

The following section will offer concluding insights and perspectives on the opportunities and challenges within the Utah hotel market.

Conclusion

This exploration of the Utah hotel market has provided a comprehensive overview of key considerations for prospective investors. From market analysis and financial performance evaluation to legal due diligence and operational strategy, understanding these facets is crucial for informed decision-making. Property location, size, and type significantly influence investment strategies and potential returns. The dynamic interplay between these factors underscores the complexity of the Utah hotel market. Furthermore, aligning investment goals with market realities and conducting thorough due diligence are essential for mitigating risks and maximizing the potential for success. Understanding the nuances of Utah’s diverse hospitality landscape, from bustling urban centers to renowned resort destinations, is paramount for informed investment choices.

The Utah hotel market presents both opportunities and challenges. Careful consideration of market dynamics, financial performance, legal complexities, and operational strategies is crucial for navigating this landscape effectively. Prospective investors are encouraged to conduct thorough research, engage qualified professionals, and develop a comprehensive understanding of the market before making investment decisions. Ultimately, success in this market hinges on informed decision-making, meticulous planning, and a clear understanding of the long-term implications of acquiring and operating a hotel in Utah.