Acquiring lodging properties in Utah presents a unique investment opportunity within the state’s thriving tourism and hospitality sector. This encompasses a wide range of establishments, from smaller boutique hotels and motels catering to specific traveler demographics to larger, full-service resorts attracting a broader clientele. Such acquisitions often include not only the physical building but also existing business operations, furnishings, and sometimes even established brand affiliations.

Utah’s diverse landscape, featuring national parks, ski resorts, and vibrant urban centers, drives a consistent demand for accommodations. This creates potential for revenue generation and long-term appreciation for investors. The state’s business-friendly environment and relatively stable economy can further enhance the attractiveness of such investments. Historically, the hospitality industry in Utah has demonstrated resilience and growth, reflecting both national trends and the state’s unique attractions.

The following sections will delve deeper into the specifics of Utah’s hospitality market, providing detailed information about current market conditions, financing options, legal considerations, and due diligence processes crucial for prospective purchasers.

Successfully acquiring a hotel in Utah requires careful planning and execution. The following tips offer guidance for potential investors to navigate the process effectively.

Tip 1: Define Investment Goals: Clearly articulate specific investment objectives. Is the goal long-term appreciation, immediate revenue generation, or a combination of both? This clarity will guide property selection and financial planning.

Tip 2: Conduct Thorough Market Research: Analyze local market dynamics, including occupancy rates, average daily rates, and competitor analysis. Understanding the local market is crucial for accurate property valuation and revenue projections.

Tip 3: Secure Professional Guidance: Enlist experienced legal and financial advisors specializing in hospitality real estate. Their expertise is invaluable in navigating complex legal and financial aspects of the acquisition process.

Tip 4: Perform Comprehensive Due Diligence: Thoroughly investigate the property’s financial history, physical condition, and legal standing. This includes reviewing existing contracts, permits, and compliance with local regulations.

Tip 5: Explore Financing Options: Research various financing options available for hospitality properties, including traditional bank loans, private equity, and Small Business Administration (SBA) loans. Secure pre-approval to demonstrate financial readiness to sellers.

Tip 6: Consider Property Management: Decide whether to self-manage the property or engage a professional management company. Weigh the potential benefits and drawbacks of each option based on experience and resources.

Tip 7: Evaluate Brand Affiliation: Assess the benefits and costs associated with existing brand affiliations or the potential for independent operation. Brand recognition can attract customers, but also entails franchise fees and operational restrictions.

By adhering to these guidelines, prospective purchasers can mitigate risks and increase the likelihood of a successful hotel acquisition in Utah’s competitive marketplace.

The insights provided in this article offer a starting point for those considering investing in Utah’s hospitality sector. Further research and professional consultation are recommended before making any investment decisions.

1. Location

Location exerts a significant influence on the value and potential profitability of a hotel investment in Utah. Careful consideration of geographic factors is paramount to successful acquisition and operation within the state’s dynamic hospitality market.

- Proximity to Demand Generators

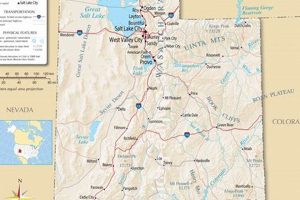

Hotels situated near major demand generators, such as national parks, ski resorts, convention centers, or bustling urban cores, typically experience higher occupancy rates and can command premium pricing. A hotel near Zion National Park, for instance, benefits from consistent tourist traffic, while a property in downtown Salt Lake City caters to both business and leisure travelers. Evaluating the strength and stability of these demand generators is essential.

- Accessibility and Transportation

Ease of access plays a critical role in attracting guests. Proximity to major highways, airports, and public transportation networks enhances convenience and influences booking decisions. Properties with limited accessibility may face challenges in attracting and retaining clientele, impacting overall profitability. Evaluating existing infrastructure and planned developments is key.

- Local Competition

The competitive landscape surrounding a potential acquisition significantly impacts its market share and pricing strategies. A thorough analysis of existing hotels, including their offerings, pricing, and target demographics, is essential. A saturated market with numerous similar establishments may present challenges, while a unique offering in a less competitive area could offer significant advantages.

- Community and Infrastructure

The surrounding community and its infrastructure play a vital role in the long-term success of a hotel. Factors such as the availability of skilled labor, local amenities, and the overall economic health of the community influence operational costs and guest satisfaction. A thriving community with a robust infrastructure can support a hotel’s growth and contribute to its long-term viability.

Strategic location analysis, therefore, is not merely about identifying a desirable setting; it requires a comprehensive understanding of market dynamics, accessibility, competition, and community factors. These elements collectively shape the potential return on investment and contribute to the long-term success of a hotel acquisition in Utah.

2. Property Type

Property type significantly influences the target market, operational strategy, and potential return on investment for hotel acquisitions in Utah. Understanding the nuances of various property types is crucial for informed decision-making within the state’s diverse hospitality landscape.

- Full-Service Hotels

These establishments offer a comprehensive range of amenities, including on-site restaurants, meeting spaces, fitness centers, and concierge services. Typically located in urban centers or resort destinations, they cater to both business and leisure travelers seeking a complete hospitality experience. Examples include large chain hotels and upscale resorts. Investment in full-service hotels often requires substantial capital and entails complex operational management.

- Limited-Service Hotels

Focused on providing essential accommodations without extensive amenities, these properties appeal to budget-conscious travelers seeking comfortable and convenient lodging. Often located near highways or secondary business districts, they offer competitive pricing and streamlined operations. Examples include budget-friendly chains and independent motels. Limited-service hotels can present a lower barrier to entry for investors and require less intensive management.

- Boutique Hotels

Characterized by unique design, personalized service, and a distinct brand identity, boutique hotels cater to niche markets seeking a curated experience. Often situated in historic buildings or trendy urban neighborhoods, they offer intimate settings and tailored services. Examples include independently owned hotels with distinctive themes or design aesthetics. Boutique hotels can command premium pricing but require careful market positioning and branding.

- Resorts

Offering a wide array of recreational activities and amenities within a self-contained environment, resorts cater to leisure travelers seeking all-inclusive experiences. Located in destinations such as ski areas, national parks, or lakefronts, they provide on-site dining, entertainment, and recreational facilities. Examples include ski resorts, golf resorts, and spa resorts. Resort properties often involve significant investment and require specialized management expertise.

Selecting the appropriate property type aligns investment strategy with target market and operational capabilities. A thorough understanding of each type’s characteristics, market positioning, and financial implications is essential for successful hotel acquisition in Utah. Due diligence should include analyzing market demand, competitive landscape, and operational requirements specific to each property type to maximize investment potential.

3. Financial Performance

Financial performance serves as a cornerstone of evaluating hotels for sale in Utah. A comprehensive understanding of a property’s financial health is crucial for informed investment decisions, enabling potential buyers to assess profitability, project future returns, and mitigate risks. Analyzing key financial metrics provides insights into operational efficiency, revenue generation capabilities, and overall market positioning.

- Revenue Analysis

Evaluating revenue streams is paramount. This involves examining historical occupancy rates, average daily rates (ADR), and revenue per available room (RevPAR). Trends in these metrics reveal market demand, pricing strategies, and overall revenue generation capabilities. Consistent growth in RevPAR, for example, suggests strong market positioning and effective management. Conversely, declining occupancy rates may indicate market saturation or operational challenges. Analyzing revenue data within the context of local market conditions provides a comprehensive understanding of a property’s performance.

- Expense Management

Scrutinizing operating expenses is essential to understanding profitability. This involves analyzing costs associated with staffing, utilities, maintenance, marketing, and property management. Efficient expense management directly impacts net operating income (NOI), a key indicator of a hotel’s financial health. Comparing operating expenses to industry benchmarks and competitor data helps identify areas for potential cost optimization and improved profitability. Understanding expense structure is crucial for projecting future cash flow and return on investment.

- Profitability Metrics

Key profitability indicators, such as NOI, capitalization rate (cap rate), and internal rate of return (IRR), offer insights into a hotel’s financial viability. NOI reflects the property’s income after operating expenses but before debt service. Cap rate, calculated by dividing NOI by the property’s value, provides a measure of potential return on investment. IRR considers the time value of money and projects the overall profitability of the investment over its lifespan. Analyzing these metrics in conjunction with revenue and expense data provides a comprehensive assessment of financial performance.

- Debt Service Coverage Ratio (DSCR)

For properties financed with debt, the DSCR is a critical metric. It measures the ability of the property’s net operating income to cover debt obligations. A DSCR above 1.0 indicates sufficient cash flow to meet debt payments, while a ratio below 1.0 suggests potential financial strain. Lenders typically require a minimum DSCR, making this metric essential for securing financing and assessing the long-term financial stability of the investment.

Thorough financial analysis is fundamental to evaluating hotels for sale in Utah. By carefully examining revenue trends, expense management, profitability metrics, and debt service capacity, potential buyers can make informed investment decisions, mitigating risks and maximizing the likelihood of a successful acquisition. This analysis should be conducted in conjunction with an assessment of market conditions, property type, and location to form a comprehensive investment strategy.

4. Market Conditions

Market conditions exert a profound influence on the landscape of hotels for sale in Utah. Analyzing prevailing economic factors, tourism trends, and competitive dynamics is crucial for both buyers and sellers to make informed decisions. These conditions directly impact property valuations, occupancy rates, average daily rates, and ultimately, the potential return on investment. Favorable market conditions, characterized by strong tourism demand, limited new supply, and robust economic growth, can drive higher property values and create attractive investment opportunities. Conversely, unfavorable conditions, such as economic downturns, increased competition, or declining tourism, can lead to lower valuations and increased risk.

For instance, during periods of economic expansion and increased tourism, demand for hotel accommodations rises, allowing existing properties to command higher prices. This can lead to increased competition among buyers, driving up acquisition costs. Conversely, during economic downturns or periods of decreased tourism, occupancy rates and average daily rates may decline, potentially leading to lower property valuations and creating opportunities for buyers seeking discounted investments. The recent surge in domestic travel within the United States, fueled by factors such as remote work flexibility and renewed interest in national parks, has positively impacted Utah’s hospitality market, creating favorable conditions for sellers. However, rising interest rates and inflationary pressures can also influence investment decisions, emphasizing the need for careful market analysis.

Understanding current market conditions is paramount for navigating the complexities of hotel transactions in Utah. Analyzing supply and demand dynamics, economic indicators, and local tourism trends provides valuable insights for assessing investment potential and making informed decisions. This analysis should be integrated with due diligence regarding a property’s financial performance, location, and property type to form a comprehensive investment strategy. Failing to adequately consider market conditions can lead to overvalued acquisitions, missed investment opportunities, or unrealistic financial projections. Therefore, thorough market research and analysis are essential components of successful hotel transactions in Utah.

5. Legal Considerations

Legal considerations form an integral part of hotel transactions in Utah, impacting every stage from initial due diligence to final closing. Navigating these legal complexities requires meticulous attention to detail and often necessitates the expertise of specialized legal counsel. Overlooking or underestimating these considerations can lead to significant financial and operational challenges, potentially jeopardizing the entire investment. These legal aspects encompass a broad range of areas, including real estate law, contract law, environmental regulations, and employment law.

Real estate law dictates the transfer of property ownership, addressing issues such as title searches, easements, and zoning regulations. A clear title ensures the buyer acquires unencumbered ownership, while zoning compliance dictates permissible land use and development restrictions. Contract law governs the purchase agreement, outlining terms and conditions, including purchase price, financing contingencies, and closing timelines. Environmental regulations require assessments for potential environmental hazards, such as asbestos or contaminated soil, imposing remediation responsibilities on the responsible party. Employment law governs employee rights and obligations, requiring compliance with state and federal labor laws, especially when existing employees are retained post-acquisition. For example, a hotel located in a protected watershed area may face stricter environmental regulations impacting development or renovation plans, while non-compliance with accessibility regulations can result in legal penalties and reputational damage.

Understanding and addressing these legal considerations is paramount for successful hotel acquisitions in Utah. Due diligence requires thorough legal review of all relevant documents, including title reports, surveys, environmental assessments, and existing contracts. Engaging experienced legal counsel specializing in hospitality real estate is crucial for navigating these complexities. This legal expertise provides guidance on compliance with local, state, and federal regulations, mitigating legal risks and ensuring a smooth transaction process. Failure to address these legal considerations can lead to costly litigation, delays in closing, or even the unraveling of the entire acquisition. Therefore, proactive legal planning and meticulous attention to detail are essential for protecting investments and ensuring the long-term viability of hotel acquisitions in Utah.

6. Growth Potential

Growth potential represents a critical factor in assessing the long-term value of hotels for sale in Utah. This potential encompasses various dimensions, including projected increases in tourism, expansion of local economies, and opportunities for property improvement or development. Understanding a property’s growth potential allows investors to evaluate not only current market value but also future appreciation and revenue generation capabilities. This forward-looking perspective is essential for informed decision-making and maximizing return on investment.

Several factors contribute to a hotel’s growth potential in Utah. Proximity to emerging tourist destinations, planned infrastructure developments, or expanding business districts can significantly enhance future demand. For example, a hotel near a newly designated national monument or a rapidly growing tech hub benefits from increased visitor traffic and business activity, driving higher occupancy rates and revenue. Similarly, properties with potential for expansion or renovation, such as adding meeting spaces, upgrading amenities, or developing adjacent land, offer opportunities to enhance value and attract a wider customer base. Conversely, hotels in stagnant or declining markets with limited potential for improvement face constrained growth prospects, impacting long-term profitability. Analyzing historical market trends, planned developments, and local economic projections provides valuable insights into a property’s growth trajectory.

Accurately assessing growth potential requires a nuanced understanding of market dynamics, economic forecasts, and local development plans. Investors must consider both macro-level trends, such as state-wide tourism projections, and micro-level factors, such as local infrastructure projects and community development initiatives. This analysis should be integrated with an evaluation of the property’s current financial performance, location, and property type to form a comprehensive investment strategy. Overlooking growth potential can lead to undervalued acquisitions or missed investment opportunities, while overestimating it can result in inflated valuations and unrealistic financial projections. Therefore, a rigorous assessment of growth potential is crucial for informed decision-making and maximizing the long-term value of hotel investments in Utah.

Frequently Asked Questions

This section addresses common inquiries regarding hotel acquisitions in Utah, providing concise and informative responses to facilitate informed decision-making.

Question 1: What are the typical price ranges for hotels currently on the market in Utah?

Hotel pricing in Utah varies significantly based on factors such as location, property type, size, condition, and revenue generation. Smaller, limited-service properties may be available in the lower millions, while larger, full-service hotels or resorts can command prices in the tens or even hundreds of millions. Market conditions also play a significant role in pricing.

Question 2: What due diligence is recommended when considering a hotel purchase in Utah?

Thorough due diligence is essential. This includes a comprehensive review of financial records, property appraisals, environmental assessments, title reports, and existing contracts. Engaging qualified legal and financial professionals specializing in hospitality real estate is highly recommended.

Question 3: What financing options are available for acquiring a hotel in Utah?

Several financing options exist, including traditional bank loans, Small Business Administration (SBA) loans, private equity investments, and joint ventures. The optimal financing structure depends on the specific acquisition, investor’s financial profile, and prevailing market conditions. Consulting with financial advisors specializing in hospitality financing is advisable.

Question 4: What are the key legal considerations involved in a hotel acquisition in Utah?

Legal considerations encompass various areas, including real estate law, contract law, environmental regulations, and employment law. Compliance with zoning ordinances, building codes, and accessibility requirements is mandatory. Thorough legal review and consultation with experienced counsel are essential to navigate these complexities.

Question 5: What are the primary challenges and opportunities in the current Utah hotel market?

Opportunities include a thriving tourism sector and strong economic growth in certain regions. Challenges include increasing competition, rising operating costs, and potential economic fluctuations. Careful market analysis and strategic planning are crucial for mitigating risks and capitalizing on opportunities.

Question 6: What is the role of professional property management in hotel operations in Utah?

Professional property management companies offer expertise in various aspects of hotel operations, including revenue management, marketing, staffing, and maintenance. Engaging professional management can optimize operational efficiency and enhance profitability, but also entails management fees. The decision to engage professional management depends on the investor’s experience and resources.

Careful consideration of these frequently asked questions provides a foundational understanding of the key aspects involved in acquiring a hotel in Utah. Further research and consultation with qualified professionals are recommended before making any investment decisions.

The next section will offer an in-depth analysis of specific market trends and investment opportunities within Utah’s dynamic hospitality sector.

Conclusion

Acquiring a hotel in Utah presents a significant investment opportunity within a dynamic and evolving hospitality landscape. This article has explored key aspects of such acquisitions, encompassing market analysis, financial considerations, legal due diligence, property type evaluations, and growth potential assessments. Strategic location, coupled with thorough financial analysis and meticulous legal preparation, are critical factors for successful investment. Understanding market conditions, including tourism trends and economic indicators, informs prudent decision-making. Property type selection aligns investment strategy with target demographics and operational capabilities.

The Utah hospitality market offers both challenges and opportunities. Navigating this market requires careful planning, informed decision-making, and a comprehensive understanding of market dynamics. Potential investors are encouraged to conduct thorough research, engage qualified professionals, and develop a robust investment strategy tailored to individual circumstances and market conditions. Strategic acquisitions, grounded in sound financial analysis and informed by market trends, position investors to capitalize on the growth potential within Utah’s vibrant hospitality sector.