Maintaining a low-cost lifestyle involves prioritizing value and resourcefulness in various aspects of daily life. This might involve seeking affordable accommodation options like hostels or budget hotels, preparing meals at home rather than dining out, utilizing public transportation or exploring free activities, and researching discounts or deals before making purchases. For example, one might choose to visit free museums instead of paid attractions or opt for grocery shopping and cooking rather than restaurant meals.

The significance of economical living is multifaceted. It enables individuals to save money for future goals, such as education, homeownership, or retirement. A mindful approach to spending also reduces financial stress and promotes a sense of control over one’s finances. Historically, periods of economic downturn have emphasized the importance of frugality and resourcefulness, highlighting the timeless value of prudent financial management.

This exploration of affordable living will delve into specific strategies for reducing expenses in areas such as accommodation, transportation, food, and entertainment, providing practical guidance for maximizing value and minimizing costs.

Tips for Maintaining an Economical Lifestyle

Implementing cost-effective strategies can significantly impact long-term financial well-being. The following tips offer practical guidance for reducing expenses without compromising quality of life.

Tip 1: Embrace Comparative Shopping: Thorough research across multiple vendors, both online and brick-and-mortar, often reveals significant price disparities for identical products or services. Utilizing price comparison websites and apps streamlines this process.

Tip 2: Prioritize Home-Cooked Meals: Preparing meals at home generally represents a substantial cost saving compared to restaurant dining or takeout. Planning meals in advance and buying groceries in bulk further enhance savings.

Tip 3: Explore Free or Low-Cost Entertainment: Numerous communities offer a wealth of free or low-cost entertainment options, including parks, museums with free admission days, community events, and libraries. Leveraging these resources significantly reduces entertainment expenses.

Tip 4: Utilize Public Transportation or Active Transportation: Opting for public transportation, cycling, or walking instead of private vehicles drastically reduces transportation costs, including fuel, maintenance, and parking fees.

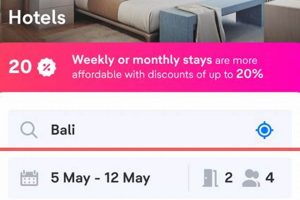

Tip 5: Seek Discounted Accommodation: Exploring budget-friendly accommodation options like hostels, guesthouses, or home-sharing platforms can substantially reduce travel costs. Booking accommodations in advance often unlocks further discounts.

Tip 6: Reduce Energy Consumption: Simple measures like turning off lights when leaving a room, unplugging electronics not in use, and adjusting the thermostat can noticeably lower utility bills.

Tip 7: Limit Subscription Services: Regularly evaluating and potentially canceling unused or underutilized subscription services, such as streaming platforms or magazine subscriptions, can yield significant savings.

Adopting these practices promotes financial stability and allows for greater flexibility in pursuing long-term financial goals. One gains a sense of control over finances and reduces unnecessary expenditures.

By integrating these strategies, individuals can establish sustainable financial habits that contribute to long-term well-being.

1. Budgeting

Budgeting serves as a cornerstone of an economical lifestyle. A well-defined budget provides a clear picture of income and expenses, enabling individuals to track spending patterns and identify areas for potential savings. This financial roadmap facilitates informed decision-making, allowing for the allocation of resources towards essential expenses while minimizing non-essential spending. For instance, a budget might reveal that a significant portion of income is allocated to dining out, prompting a shift towards home-cooked meals. This conscious reallocation of resources directly contributes to reducing overall expenses.

The practice of budgeting not only highlights areas for immediate savings but also fosters financial discipline. By adhering to a predetermined spending plan, individuals develop a greater awareness of their financial habits and gain control over impulsive purchases. This heightened awareness translates into more conscious spending choices, leading to further cost savings. For example, a budget might allocate a specific amount for entertainment, encouraging individuals to seek free or low-cost options rather than expensive outings. This mindful approach contributes to sustained, long-term cost savings.

In essence, budgeting empowers individuals to make informed financial decisions that align with their financial goals. This process facilitates the identification of areas for cost reduction, promotes financial discipline, and ultimately enables the adoption and maintenance of an economical lifestyle. While creating and adhering to a budget requires initial effort, the long-term benefits of financial stability and reduced stress significantly outweigh the initial investment of time and effort. This understanding highlights the critical role of budgeting in achieving and sustaining a low-cost lifestyle.

2. Resourcefulness

Resourcefulness plays a crucial role in maintaining an economical lifestyle. It involves creatively utilizing available resources to meet needs and achieve goals without incurring unnecessary expenses. This approach emphasizes maximizing the value of existing possessions, repurposing items, and seeking alternative solutions to traditional consumption patterns. Resourcefulness fosters a mindset of problem-solving and adaptability, essential components of cost-effective living.

- Repurposing and Upcycling

Repurposing involves finding new uses for existing items rather than discarding them. This might include transforming old clothing into cleaning rags, using glass jars for storage, or turning discarded wood into shelving. Upcycling takes repurposing a step further by creatively transforming unwanted items into new products of higher value. For example, old t-shirts can be upcycled into reusable shopping bags, or worn-out furniture can be refurbished into unique, stylish pieces. These practices reduce waste, minimize the need for new purchases, and contribute significantly to cost savings.

- DIY and Repair

Developing basic do-it-yourself (DIY) and repair skills empowers individuals to address common household needs without relying on paid services. Simple repairs, such as patching holes in clothing or fixing leaky faucets, prevent the need for replacements or costly professional interventions. Embracing DIY projects, like building furniture or creating home decor, offers a cost-effective alternative to purchasing new items. These skills foster self-sufficiency and contribute substantially to long-term cost savings.

- Utilizing Community Resources

Many communities offer a wealth of free or low-cost resources, such as libraries, community centers, and parks. Libraries provide access to books, movies, and internet access, reducing entertainment expenses. Community centers often offer free or low-cost classes, workshops, and recreational activities. Parks provide opportunities for outdoor recreation, eliminating the need for costly gym memberships or entertainment venues. Leveraging these resources enhances quality of life while minimizing expenses.

- Bartering and Sharing

Bartering involves exchanging goods or services without the use of money. This practice can be particularly effective within communities or online platforms, allowing individuals to acquire needed items or services without incurring financial costs. Sharing resources, such as tools, equipment, or even vehicles, amongst neighbors or friends, minimizes the need for individual purchases and fosters a sense of community. These collaborative practices reduce consumption and contribute to a more sustainable and economical lifestyle.

These facets of resourcefulness demonstrate a proactive and creative approach to managing resources. By embracing these practices, individuals can significantly reduce expenses, minimize waste, and achieve a more sustainable and fulfilling lifestyle. Resourcefulness is not merely about saving money; it cultivates a mindset of problem-solving and adaptability, essential qualities for navigating financial challenges and achieving long-term financial well-being within the framework of an economical lifestyle.

3. Value-seeking

Value-seeking represents a cornerstone of maintaining an economical lifestyle. It involves a conscious effort to prioritize cost-effectiveness over brand names, trends, or perceived status. This approach requires careful consideration of needs versus wants, focusing on acquiring goods and services that offer the greatest utility for the lowest possible price. Value-seeking does not equate to simply buying the cheapest option; it involves evaluating quality, durability, and long-term cost-effectiveness. For example, investing in a slightly more expensive, energy-efficient appliance might offer greater long-term value due to reduced energy consumption compared to a cheaper, less efficient model. This proactive approach to purchasing decisions forms a critical component of a sustainable low-cost lifestyle.

The practical significance of value-seeking manifests in several ways. Comparative shopping, researching product reviews, and considering alternative brands or options contribute to informed purchasing decisions. Seeking discounts, utilizing coupons, and taking advantage of sales promotions further maximize cost savings. Value-seeking also extends beyond tangible goods, encompassing services such as insurance, telecommunications, and entertainment. For instance, opting for a less expensive streaming service that still meets entertainment needs, or bundling insurance policies to secure a lower premium, exemplifies value-seeking behavior. These practices, when consistently applied, significantly reduce overall expenses and contribute to the long-term sustainability of an economical lifestyle.

In conclusion, value-seeking acts as a crucial component of maintaining a low-cost lifestyle. This approach necessitates careful evaluation of purchases, prioritizing utility and long-term cost-effectiveness over superficial factors. By embracing value-seeking behaviors, individuals gain greater control over their finances, reduce unnecessary expenses, and establish a foundation for long-term financial stability. Challenges might arise in balancing desires for specific brands or trends with the need for affordability, requiring a disciplined approach to spending decisions. Ultimately, value-seeking empowers individuals to make informed choices that align with their financial goals and contribute to a more sustainable and economical lifestyle.

4. Disciplined Spending

Disciplined spending forms an integral component of maintaining an economical lifestyle. It involves a conscious and consistent effort to control impulsive purchases and prioritize essential expenditures over non-essential ones. This practice requires a clear understanding of financial goals and a commitment to adhering to a predetermined budget. Cause and effect come into play: disciplined spending leads to lower overall expenses, directly contributing to the ability to “stay cheap.” For example, resisting the urge to buy a new gadget when the current one functions adequately demonstrates disciplined spending and directly contributes to cost savings. The absence of disciplined spending often results in unnecessary debt and financial strain, hindering the ability to maintain a low-cost lifestyle.

The importance of disciplined spending as a component of an economical lifestyle cannot be overstated. It empowers individuals to make informed financial decisions, aligning spending with long-term goals rather than fleeting desires. Consider the example of someone saving for a down payment on a house. Disciplined spending, such as brewing coffee at home instead of buying it daily, allows them to allocate more funds towards their savings goal, accelerating their progress and reinforcing the connection between disciplined spending and achieving larger financial objectives. Practical applications of disciplined spending can also involve setting spending limits for specific categories like entertainment or clothing, using cash instead of credit cards to increase awareness of spending, and implementing a waiting period before making non-essential purchases to reduce impulse buying.

In summary, disciplined spending acts as a cornerstone of an economical lifestyle. It requires conscious effort, planning, and a clear understanding of one’s financial priorities. While challenges may arise, such as social pressures to spend or unexpected expenses, cultivating disciplined spending habits provides a strong foundation for long-term financial stability and the ability to maintain a low-cost lifestyle. This understanding allows individuals to navigate financial decisions effectively and achieve long-term financial well-being, directly supporting the overall goal of living economically.

5. Planning

Planning plays a crucial role in maintaining an economical lifestyle. A well-structured plan facilitates informed decision-making, allowing for the strategic allocation of resources and the avoidance of unnecessary expenditures. Proactive planning, whether for meals, travel, or larger purchases, empowers individuals to make cost-effective choices and maximize value. This foresight contributes significantly to the ability to maintain a low-cost lifestyle.

- Meal Planning

Meal planning involves creating a structured approach to meals for a specific period, often a week. This practice allows for organized grocery shopping, reducing food waste and minimizing impulse purchases at the grocery store. Planning meals in advance also facilitates the utilization of leftovers, further maximizing the value of food purchases and minimizing waste. For example, planning to use leftover roasted chicken in salads or sandwiches later in the week demonstrates efficient resource management. This proactive approach contributes substantially to reducing food costs, a significant aspect of economical living.

- Travel Planning

Travel planning involves researching and organizing the various aspects of a trip, including transportation, accommodation, and activities. Booking flights and accommodations in advance often yields lower prices, and researching free or low-cost activities at the destination minimizes entertainment expenses. For instance, exploring local parks, free museums, or community events offers enriching experiences without significant cost. Thorough travel planning also allows for the anticipation of potential expenses, such as visa fees or travel insurance, facilitating informed budgeting and preventing unexpected financial burdens.

- Financial Planning

Financial planning encompasses a broader approach to managing finances, including budgeting, saving, and investing. Creating a budget provides a clear overview of income and expenses, allowing for the identification of areas for potential savings. Setting financial goals, such as saving for a down payment on a house or retirement, provides a framework for disciplined spending and motivates adherence to a budget. Regularly reviewing and adjusting financial plans ensures alignment with evolving circumstances and reinforces commitment to long-term financial goals. This proactive approach to financial management is crucial for sustaining a low-cost lifestyle.

- Contingency Planning

Contingency planning involves anticipating potential unexpected expenses and developing strategies to address them. This might include setting aside funds for emergency repairs, unexpected medical bills, or job loss. Having a financial cushion mitigates the impact of unforeseen events and prevents reliance on high-interest debt, such as credit cards. For example, having an emergency fund allows for the repair of a broken appliance without resorting to credit card debt, preserving long-term financial stability. This proactive approach to risk management plays a vital role in maintaining an economical lifestyle, providing a buffer against unforeseen financial challenges.

These facets of planning demonstrate the importance of proactive organization and foresight in maintaining an economical lifestyle. By incorporating planning into various aspects of daily life, from meals to finances, individuals gain greater control over their spending, reduce unnecessary expenses, and build a foundation for long-term financial well-being. While planning requires initial effort and organization, the long-term benefits of reduced stress, increased financial stability, and the ability to pursue financial goals significantly outweigh the initial investment. This comprehensive approach to planning reinforces the crucial role it plays in successfully maintaining a low-cost lifestyle.

Frequently Asked Questions about Economical Living

This section addresses common inquiries regarding the adoption and maintenance of a cost-effective lifestyle. The provided information aims to clarify potential misconceptions and offer practical guidance.

Question 1: Does economical living necessitate a drastic reduction in quality of life?

No. Economical living focuses on maximizing value and minimizing unnecessary expenditures, not deprivation. It involves making informed decisions about spending and prioritizing needs over wants. One can maintain a fulfilling lifestyle while prioritizing value.

Question 2: Is economical living only relevant for individuals with low incomes?

No. Individuals across all income levels can benefit from adopting economical practices. Mindful spending habits contribute to financial stability and enable individuals to allocate resources towards long-term financial goals, regardless of income level.

Question 3: Does maintaining an economical lifestyle require significant time and effort?

Initially, establishing economical habits may require some effort, such as creating a budget or researching cost-effective alternatives. However, these practices often become ingrained habits, ultimately saving time and reducing financial stress.

Question 4: How does one balance the desire for occasional indulgences with an economical lifestyle?

Balance is key. A budget can incorporate allocated funds for occasional treats or non-essential purchases. Mindful planning and disciplined spending allow for occasional indulgences without compromising long-term financial goals.

Question 5: Where can one find reliable resources and information regarding economical living practices?

Numerous online resources, books, and community workshops offer guidance on various aspects of economical living, from budgeting and meal planning to DIY projects and energy conservation. Reputable financial advisors can also provide personalized guidance.

Question 6: How does one maintain motivation and avoid feelings of deprivation while embracing economical living?

Focusing on the long-term benefits, such as financial security and achieving financial goals, helps maintain motivation. Reframing economical living as a path towards greater financial freedom, rather than a restriction, can foster a positive perspective. Celebrating small victories and acknowledging progress further reinforces commitment.

Key takeaways include the understanding that economical living is not about deprivation but rather informed resource management. It is a sustainable practice beneficial for individuals across all income levels, promoting financial stability and enabling the achievement of long-term financial objectives.

The subsequent section will offer practical tips and strategies for implementing cost-effective practices in various aspects of daily life.

Conclusion

Maintaining a low-cost lifestyle requires a multifaceted approach encompassing budgeting, resourcefulness, value-seeking, disciplined spending, and planning. Each component contributes significantly to reducing expenses and maximizing resources. Budgeting provides a financial roadmap, while resourcefulness encourages creative solutions. Value-seeking prioritizes cost-effectiveness, and disciplined spending curbs impulsive purchases. Planning facilitates informed decision-making, enabling proactive and cost-effective choices. The synthesis of these elements forms a robust framework for achieving and sustaining an affordable lifestyle.

The ability to manage finances effectively contributes significantly to long-term financial stability and overall well-being. Adopting and maintaining affordable living practices empowers individuals to achieve financial goals, reduce financial stress, and navigate economic fluctuations with greater resilience. A mindful approach to spending allows for greater control over one’s financial destiny, creating opportunities for future investments and enhancing overall quality of life. The significance of affordable living extends beyond mere cost reduction; it fosters a sense of financial empowerment and provides a foundation for a more secure and fulfilling future.