Real estate investment within the United States lodging sector encompasses a broad range of activities, from acquiring and developing individual properties to managing large portfolios of hotels and resorts. This specialized market segment involves diverse property types, including budget-friendly motels, extended-stay facilities, full-service hotels, and luxury resorts. An example of a typical transaction might involve the purchase of an existing urban hotel for renovation and repositioning within the market.

Investing in the hospitality sector offers potential for substantial returns driven by factors such as tourism growth, economic expansion, and strategic property management. Historically, this market has demonstrated resilience, recovering from economic downturns and adapting to evolving traveler preferences. Successful investment strategies often leverage market analysis, careful property selection, and effective operational management to maximize profitability and long-term value creation.

Further exploration of this dynamic market can involve analyzing current trends, understanding the impact of economic indicators, and examining successful investment strategies. Key topics include market segmentation, risk assessment, financing options, and the influence of technological advancements on the hospitality industry.

Tips for U.S. Lodging Real Estate Investment

Navigating the complexities of hospitality real estate requires careful consideration of market dynamics and strategic decision-making. The following tips offer guidance for successful investment in this sector.

Tip 1: Conduct Thorough Market Research: Understanding local market conditions, including occupancy rates, average daily rates, and competitor analysis, is crucial. Data-driven insights inform investment decisions and mitigate potential risks.

Tip 2: Assess Property Condition and Potential: A detailed evaluation of the physical property, including infrastructure, amenities, and potential for renovation or expansion, helps determine long-term viability and return on investment.

Tip 3: Develop a Robust Business Plan: A comprehensive plan outlining financial projections, operational strategies, and marketing initiatives is essential for securing financing and achieving investment goals.

Tip 4: Explore Diverse Financing Options: Understanding available financing options, including traditional loans, private equity, and joint ventures, allows investors to secure optimal capital structures.

Tip 5: Consider Professional Property Management: Experienced property management companies can optimize operations, enhance guest experiences, and maximize revenue generation.

Tip 6: Stay Informed About Industry Trends: Monitoring evolving traveler preferences, technological advancements, and economic indicators allows investors to adapt strategies and maintain a competitive edge.

Tip 7: Evaluate Legal and Regulatory Compliance: Ensuring adherence to local, state, and federal regulations related to zoning, licensing, and accessibility is paramount for successful operation.

By implementing these strategies, investors can enhance their prospects for success in the dynamic U.S. lodging real estate market. These key considerations contribute to informed decision-making, risk mitigation, and long-term value creation.

By incorporating these insights, stakeholders can approach investment decisions with greater clarity and confidence, ultimately contributing to sustained growth and profitability within the hospitality sector.

1. Market Analysis

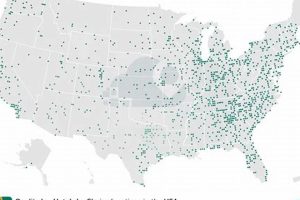

Market analysis forms the bedrock of successful hotel real estate investment in the United States. It provides crucial insights into supply and demand dynamics, local economic conditions, competitor performance, and emerging trends. This data-driven approach allows investors to identify promising opportunities, mitigate potential risks, and make informed decisions regarding property acquisition, development, and management. For example, a market analysis might reveal an unmet demand for extended-stay hotels in a growing business district, justifying investment in this specific segment. Conversely, an oversupply of luxury resorts in a saturated market might signal a need for cautious investment or a shift in strategy. Understanding market segmentation, occupancy rates, average daily rates, and revenue per available room (RevPAR) are crucial components of a thorough analysis. This analysis extends beyond simple metrics to encompass qualitative factors such as local events, tourism patterns, and future development plans that might impact property performance.

The practical implications of a robust market analysis are substantial. It informs decisions regarding property valuation, financial projections, and operational strategies. For instance, understanding the competitive landscape allows investors to position their properties effectively, optimize pricing strategies, and target specific customer segments. Moreover, market analysis supports effective risk management by identifying potential challenges and informing contingency plans. This proactive approach can mitigate the impact of economic downturns, changing travel patterns, or increased competition. In the case of a new hotel development, a market analysis might reveal the need for specific amenities or services to attract the target demographic, thereby enhancing the project’s feasibility and long-term success.

In conclusion, thorough market analysis is an indispensable component of successful hotel real estate investment. Its ability to provide crucial insights into market dynamics, identify opportunities and risks, and inform strategic decision-making directly impacts investment outcomes. Challenges such as data availability and interpretation require careful consideration. However, overcoming these challenges through rigorous research and expert consultation ultimately contributes to informed investment choices and sustainable growth within the U.S. lodging sector.

2. Property Valuation

Accurate property valuation is fundamental to successful investment in the U.S. hotel real estate market. It provides a critical benchmark for investment decisions, financing negotiations, and portfolio management. Understanding the factors that influence hotel property values allows stakeholders to make informed choices and maximize returns.

- Income Approach

The income approach, often utilizing discounted cash flow (DCF) analysis, projects future revenue streams to determine present value. This method considers factors like occupancy rates, average daily rates, and operating expenses. For example, a hotel with consistently high occupancy and strong cash flow will typically command a higher valuation. In the context of U.S. hotel real estate, the income approach is particularly relevant due to the income-generating nature of these assets.

- Market Approach

The market approach compares the subject property to similar recently sold hotels in the same market. This method considers factors such as location, size, amenities, and brand affiliation. For instance, a boutique hotel in a prime urban location might be compared to similar properties recently transacted in the same area. This comparative analysis provides a market-based valuation relevant to the competitive landscape of the U.S. lodging sector.

- Cost Approach

The cost approach estimates the replacement cost of the property, considering land value and construction costs. This method is particularly relevant for newer hotels or those with unique features. For example, a newly constructed resort with specialized amenities would be evaluated based on the cost to replicate such a property. This approach is less common for established hotels in the U.S. market but can be valuable in specific circumstances.

- Impact of Brand and Management

Brand affiliation and management quality significantly influence hotel valuations. A well-regarded brand can enhance a property’s marketability and revenue potential. Similarly, strong management practices can optimize operations and drive profitability. For instance, a hotel affiliated with a luxury brand and managed by an experienced operator will typically command a premium valuation in the U.S. market. This intangible factor underscores the importance of brand reputation and operational excellence in hotel real estate investment.

These valuation methods provide a comprehensive framework for assessing hotel properties within the U.S. real estate market. By considering these approaches in conjunction with market analysis and due diligence, investors can make informed decisions, mitigate risks, and maximize the potential for successful investment outcomes. Understanding the interplay of these factors is essential for navigating the complexities of the U.S. lodging sector and achieving long-term value creation.

3. Financial Modeling

Financial modeling plays a crucial role in U.S. hotel real estate investment, providing a framework for evaluating investment opportunities and making informed decisions. It allows stakeholders to project future performance, assess financial feasibility, and understand the potential risks and returns associated with a particular investment. Robust financial models incorporate key market data, property-specific information, and relevant economic assumptions to provide a comprehensive view of an investment’s potential.

- Revenue Projections

Developing accurate revenue projections is a cornerstone of hotel financial modeling. This involves forecasting occupancy rates, average daily rates, and other revenue streams, such as food and beverage sales and conference room rentals. Historical data, market trends, and competitive analysis inform these projections. For example, a model might project revenue growth based on anticipated increases in tourism or planned local events. Accurate revenue projections are essential for determining a property’s income potential and assessing its overall financial viability.

- Operating Expense Analysis

A detailed analysis of operating expenses is critical for understanding a hotel’s profitability. This includes forecasting costs associated with staffing, utilities, maintenance, marketing, and property management. Accurate expense projections are essential for determining net operating income (NOI) and evaluating a property’s cash flow potential. For instance, a model might incorporate rising labor costs or increasing utility rates to provide a realistic assessment of future operating expenses and their impact on profitability.

- Capital Expenditure Planning

Forecasting capital expenditures (CAPEX) is essential for long-term financial planning in hotel real estate. CAPEX includes investments in renovations, upgrades, and replacements of major building systems. Accurately projecting these expenditures is vital for assessing the overall investment cost and understanding the impact on future cash flows. For example, a model might incorporate planned renovations or upgrades to guest rooms and common areas, reflecting the ongoing investment required to maintain a competitive position in the market.

- Valuation and Sensitivity Analysis

Financial models are used to estimate property values using various valuation methods, such as discounted cash flow analysis. Sensitivity analysis assesses the impact of changes in key assumptions on the model’s outputs. This allows investors to understand the potential range of outcomes and identify key drivers of value. For instance, a sensitivity analysis might explore the impact of changes in occupancy rates or interest rates on the overall valuation and investment returns. This process helps investors assess the risks and uncertainties associated with the investment.

By integrating these facets, financial modeling provides a comprehensive framework for evaluating investment opportunities in U.S. hotel real estate. It allows investors to analyze potential returns, assess risks, and make informed decisions aligned with their investment objectives. The insights gained from financial modeling are critical for navigating the complexities of the lodging sector and maximizing the potential for long-term value creation.

4. Risk Management

Risk management is integral to successful hotel real estate investment in the United States. The lodging sector faces inherent vulnerabilities to economic downturns, changing travel patterns, natural disasters, and disruptive technologies. Effective risk management frameworks help mitigate these potential threats and safeguard investments. For example, during the 2008 financial crisis, hotels experienced significant declines in occupancy and revenue. Properties with robust risk management strategies, including diversified revenue streams and strong cost controls, were better positioned to weather the downturn. Conversely, those with limited risk mitigation measures faced greater financial distress.

Implementing robust risk management practices involves several key steps. Thorough market analysis identifies potential risks specific to a particular location or market segment. For example, a coastal property might face heightened exposure to hurricane risk, requiring specific insurance coverage and disaster preparedness plans. Financial modeling incorporates sensitivity analysis to assess the impact of various economic scenarios on investment performance. Diversification across different property types and geographic locations can mitigate portfolio-wide risks. Strong operational practices, including efficient cost management and revenue optimization strategies, enhance resilience during challenging market conditions. For instance, implementing energy-efficient technologies can mitigate the impact of rising utility costs, while dynamic pricing strategies can optimize revenue during periods of fluctuating demand. Regularly reviewing and updating risk management plans ensures their continued effectiveness in a dynamic market environment.

Effective risk management is not merely a protective measure but a strategic advantage in the U.S. hotel real estate market. It enables informed decision-making, enhances investor confidence, and contributes to long-term value creation. While challenges such as unforeseen events and evolving market dynamics persist, a proactive and adaptable risk management approach strengthens resilience and positions investments for sustained success within the hospitality sector. Neglecting this critical aspect can expose investments to significant vulnerabilities, potentially leading to financial losses and diminished returns.

5. Legal Compliance

Legal compliance forms a critical cornerstone of successful hotel real estate investment in the United States. Adherence to a complex web of federal, state, and local regulations is essential for sustainable operations and long-term value creation. Neglecting legal compliance can expose investors to significant financial and reputational risks. This overview explores key facets of legal compliance within the U.S. lodging sector.

- Americans with Disabilities Act (ADA) Compliance

The ADA mandates accessibility for individuals with disabilities in places of public accommodation, including hotels. Compliance encompasses physical accessibility features, such as ramps, elevators, and accessible guest rooms, as well as effective communication practices for guests with hearing or visual impairments. Non-compliance can result in substantial fines and legal action. For instance, a hotel lacking sufficient accessible parking spaces or failing to provide appropriate signage might face penalties and reputational damage. Ensuring ADA compliance is not only a legal obligation but also a sound business practice, fostering inclusivity and expanding market reach.

- Zoning and Building Codes

Local zoning ordinances and building codes dictate permissible land use, building height restrictions, parking requirements, and fire safety standards. Securing necessary permits and approvals is essential before commencing any construction or renovation project. Failure to comply with these regulations can lead to project delays, costly fines, and even legal action to halt construction. For example, a hotel development exceeding permissible height restrictions might face legal challenges and be forced to modify its design. Careful consideration of zoning and building codes is crucial for ensuring project feasibility and avoiding costly legal disputes.

- Alcohol Licensing and Regulations

Hotels serving alcoholic beverages must comply with state and local licensing requirements, which vary significantly across jurisdictions. These regulations often govern permitted hours of operation, types of licenses required, and responsible service of alcohol training for staff. Non-compliance can result in license revocation, fines, and potential legal liability. For instance, a hotel serving alcohol outside of permitted hours or to underage patrons might face severe penalties. Understanding and adhering to alcohol licensing regulations is essential for operating a hotel bar or restaurant legally and responsibly.

- Employment and Labor Laws

Hotels, as employers, must comply with federal and state labor laws governing minimum wage, overtime pay, workplace safety, and anti-discrimination practices. Maintaining accurate employment records, providing required benefits, and fostering a safe and equitable work environment are essential for avoiding legal challenges and maintaining a positive employer reputation. For example, a hotel failing to pay employees minimum wage or providing adequate safety training might face legal action and reputational damage. Compliance with employment and labor laws is crucial for attracting and retaining qualified staff and fostering a productive work environment.

These facets of legal compliance are interconnected and essential for successful hotel real estate investment in the United States. Navigating this complex regulatory landscape requires proactive engagement with legal counsel specializing in hospitality law. Failure to prioritize legal compliance can expose investors to substantial financial and reputational risks, undermining the long-term viability of their investments. By prioritizing legal compliance, investors mitigate risks, foster positive relationships with local communities, and contribute to the sustainable growth of the U.S. lodging sector.

Frequently Asked Questions

This section addresses common inquiries regarding investment in United States hotel properties, providing concise yet informative responses.

Question 1: What are the primary drivers of U.S. hotel real estate values?

Key factors influencing hotel valuations include market conditions (supply and demand dynamics, local economic health), property specifics (location, age, condition, amenities), brand affiliation, management quality, and financial performance (revenue, expenses, cash flow).

Question 2: How does economic volatility impact hotel investments?

Economic downturns can significantly impact travel demand, leading to reduced occupancy rates and revenue. Properties with strong risk management strategies, diversified revenue streams, and efficient cost controls are better positioned to withstand economic volatility.

Question 3: What are the key legal and regulatory considerations for hotel investors?

Critical legal aspects include compliance with the Americans with Disabilities Act (ADA), adherence to zoning and building codes, securing necessary licenses (e.g., alcohol service), and compliance with employment and labor laws. Consulting specialized legal counsel is crucial.

Question 4: What due diligence is essential before investing in a hotel property?

Essential due diligence encompasses thorough market analysis, property condition assessment, financial review and projections, legal compliance verification, and evaluation of existing management and brand affiliations.

Question 5: How does technology influence hotel real estate investment?

Technological advancements impact hotel operations, guest experience, and revenue management. Investors must consider the integration of property management systems, online booking platforms, guest-facing technologies, and data analytics for informed decision-making.

Question 6: What are the different types of hotel investments available in the U.S.?

Investment opportunities range from acquiring existing properties (limited-service hotels, full-service hotels, resorts) to developing new projects. Investment strategies may include direct ownership, joint ventures, or participation in real estate investment trusts (REITs).

Understanding these facets contributes to informed decision-making in the dynamic landscape of U.S. hotel real estate investment.

For further insights, explore resources such as industry reports, market analyses, and consultations with experienced hospitality professionals.

American Hotel Real Estate

Investing in United States hotel real estate presents a complex yet potentially rewarding opportunity. This exploration has highlighted the multifaceted nature of the sector, encompassing market analysis, property valuation, financial modeling, risk management, and legal compliance. Each of these facets plays a crucial role in informing investment decisions and maximizing the potential for successful outcomes. Understanding market dynamics, conducting thorough due diligence, and implementing robust risk mitigation strategies are essential for navigating the inherent challenges of the hospitality industry. Furthermore, adherence to legal and regulatory frameworks is paramount for sustainable operations and long-term value creation.

The U.S. lodging sector remains a dynamic and evolving landscape, influenced by economic fluctuations, changing travel patterns, and technological advancements. Success in this market requires adaptability, informed decision-making, and a long-term perspective. Stakeholders who prioritize rigorous analysis, strategic planning, and operational excellence are best positioned to capitalize on the opportunities presented by this dynamic sector. Continued exploration of market trends, emerging technologies, and evolving guest preferences will be crucial for sustained success in the competitive arena of American hotel real estate.