The Utah lodging market presents opportunities for acquiring established businesses. These opportunities encompass a range of property types, from smaller motels and inns to larger, full-service hotels, often located in diverse settings, including bustling urban centers, popular tourist destinations, and scenic rural areas. Potential investors can find listings for properties currently on the market, providing detailed information regarding location, size, amenities, and financial performance.

Acquiring an existing hospitality business in Utah offers several advantages. Established properties may already have a loyal customer base and operational infrastructure, potentially streamlining the entry process for new owners. Utah’s robust tourism industry and diverse economy contribute to the potential for a stable revenue stream. Furthermore, the state’s varied landscapes and recreational opportunities create a desirable environment for attracting both leisure and business travelers. Historical context, including past market trends and development patterns, can inform investment decisions and provide valuable insights into the long-term potential of individual properties.

This information serves as a starting point for exploring various aspects of the Utah hospitality market. Deeper dives into specific property types, regional market analyses, financial considerations, and legal aspects of acquisition will provide a more comprehensive understanding of the opportunities and challenges within this dynamic sector.

Careful consideration of several key factors is recommended when exploring the acquisition of a hotel property in Utah.

Tip 1: Define Investment Goals: Clearly articulate specific investment objectives. Is the goal primarily capital appreciation, steady cash flow, or a combination of both? Defining these objectives will guide the property search and selection process.

Tip 2: Conduct Thorough Due Diligence: Rigorous due diligence is essential. This includes a detailed review of financial records, property condition assessments, and market analyses to identify potential risks and opportunities.

Tip 3: Understand Local Market Dynamics: Each region within Utah possesses unique market characteristics. Researching occupancy rates, average daily rates, and local competition provides valuable insights into a property’s potential performance.

Tip 4: Secure Experienced Legal Counsel: Navigating the legal complexities of property acquisition requires expert guidance. Experienced legal counsel can ensure compliance with all regulations and protect investor interests.

Tip 5: Explore Financing Options: Understanding available financing options and securing pre-approval can streamline the acquisition process. Explore various lending institutions and loan structures to identify the most favorable terms.

Tip 6: Evaluate Management Expertise: Assess the existing management team or consider engaging experienced hotel management professionals. Effective management is crucial for optimizing operational efficiency and maximizing revenue.

Tip 7: Consider Property Improvements: Evaluate potential property improvements or renovations that could enhance value and attract guests. Analyzing potential return on investment for such improvements is essential.

By carefully considering these factors, potential investors can make informed decisions and maximize the likelihood of a successful acquisition in the Utah hotel market.

These tips provide a foundation for a successful investment strategy. Further research and consultation with industry professionals are recommended to navigate the complexities of the Utah hospitality market effectively.

1. Property Location

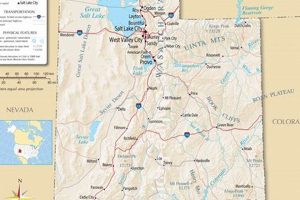

Property location significantly impacts the value and potential of hotels for sale in Utah. Factors such as proximity to major tourist attractions, urban centers, transportation hubs, and natural landscapes directly influence occupancy rates, average daily rates, and overall profitability. A hotel located near Zion National Park, for example, is likely to command higher prices and experience greater demand during peak tourist seasons compared to a similar property in a less-visited area. Conversely, a hotel situated in a business district like downtown Salt Lake City may cater to a different clientele and rely on corporate travel and conferences for revenue generation. Location also affects operating costs, including property taxes, insurance rates, and utility expenses, which vary across different municipalities and regions within Utah.

Analyzing location demographics, including population density, income levels, and tourism trends, provides crucial insights for potential investors. Understanding the local competitive landscape, considering the proximity of other hotels and lodging options, is equally critical. A thorough location analysis should also encompass accessibility, considering highway access, public transportation options, and airport proximity. For example, a hotel located near a major interstate may benefit from higher visibility and easier access for travelers, while a remote mountain lodge may appeal to a niche market seeking seclusion and tranquility. The interplay of these factors ultimately determines the market positioning and long-term viability of a hotel property.

Careful consideration of property location is therefore essential for successful investment in the Utah hotel market. A comprehensive location analysis, encompassing both quantitative and qualitative factors, enables informed decision-making and mitigates potential risks. Understanding the nuances of each specific locale and its impact on hotel operations is crucial for maximizing investment returns and achieving long-term financial goals.

2. Property Type

Property type significantly influences the investment potential of hotels for sale in Utah. Distinct categories cater to specific market segments, impacting operational strategies, revenue projections, and target demographics. Classifications range from budget-friendly motels and limited-service hotels to full-service resorts and boutique properties. Each type presents unique operational considerations and financial dynamics. For example, a limited-service hotel may require lower staffing levels and operating costs compared to a full-service resort offering amenities such as restaurants, spas, and conference facilities. Boutique hotels, often characterized by unique design and personalized service, typically attract a distinct clientele seeking a more individualized experience. Understanding these distinctions is crucial for aligning investment objectives with market demand and operational capabilities.

The selection of property type directly correlates with target demographics and pricing strategies. Budget motels cater to value-conscious travelers, while luxury resorts attract a more affluent clientele. Extended-stay hotels, designed for longer visits, often appeal to business travelers or families relocating. The property type also influences marketing and branding efforts. A historic inn may emphasize its unique charm and historical significance, while a modern, business-oriented hotel may focus on convenience and technological amenities. Analyzing local market demand and identifying underserved segments can guide property type selection and maximize investment returns. For instance, a region experiencing growth in adventure tourism may present opportunities for investing in lodges or cabin rentals, while a city with a thriving convention center may benefit from additional full-service hotel capacity.

Careful consideration of property type within the context of the broader Utah hospitality market is essential for successful investment. Aligning property type with market demand, operational expertise, and investment goals enhances the likelihood of long-term profitability and value appreciation. Understanding the operational nuances and financial implications associated with each property type allows for informed decision-making and strategic positioning within the competitive landscape.

3. Financial Performance

Financial performance serves as a critical indicator of a hotel’s investment potential in the Utah market. Analyzing key metrics, including historical occupancy rates, average daily rates (ADR), revenue per available room (RevPAR), and operating expenses, provides valuable insights into a property’s profitability and market positioning. Examining trends in these metrics over time reveals patterns of growth, seasonality, and response to market fluctuations. For example, a hotel demonstrating consistent growth in RevPAR over several years suggests strong management and market demand, while declining occupancy rates may indicate increased competition or changing market dynamics. Understanding these financial indicators is crucial for assessing investment risk and projecting future returns. Due diligence should include a thorough review of financial statements, including income statements, balance sheets, and cash flow statements, to verify the accuracy and reliability of reported data.

Evaluating financial performance requires contextualization within the broader market. Comparing a hotel’s metrics to industry benchmarks and competitors’ performance provides a relative assessment of its financial health and operational efficiency. Factors such as local market conditions, economic trends, and tourism patterns can significantly influence a property’s financial performance. For instance, a hotel located in a rapidly growing tourist destination may exhibit higher occupancy rates and ADR compared to a similar property in a more mature market. Examining the competitive landscape, including the number and type of competing hotels in the vicinity, provides further context for interpreting financial data. Furthermore, understanding the hotel’s historical capital expenditures and planned renovations allows for a more comprehensive assessment of potential future expenses and their impact on profitability.

Thorough analysis of financial performance is essential for making informed investment decisions in the Utah hotel market. Evaluating historical trends, comparing performance to industry benchmarks, and understanding the influence of market dynamics provide a comprehensive picture of a property’s financial health and potential for future growth. This analysis, coupled with a detailed understanding of market conditions and operational efficiency, enables investors to assess risk, project future returns, and make strategic investment decisions aligned with their financial objectives. Neglecting this crucial aspect of due diligence can lead to misinformed investment choices and potentially jeopardize financial success.

4. Market Analysis

Market analysis forms a cornerstone of informed decision-making when considering hotels for sale in Utah. A comprehensive understanding of market dynamics, including supply and demand factors, competitive landscapes, and prevailing economic conditions, is crucial for assessing investment potential and mitigating risk. Effective market analysis provides insights into current market values, projected growth trajectories, and potential challenges, enabling investors to make strategic acquisitions aligned with market realities.

- Competitive Landscape

Analyzing the competitive landscape involves identifying existing hotels and lodging options in the vicinity, understanding their pricing strategies, occupancy rates, and target demographics. This analysis reveals the level of competition for a given property, informing pricing decisions and marketing strategies. For example, a market saturated with luxury hotels may present challenges for a new entrant in the same segment, while a niche market with limited boutique hotel options may offer opportunities for differentiation and premium pricing. Understanding competitor strengths and weaknesses allows potential investors to identify competitive advantages and develop effective market positioning strategies.

- Demand Generators

Identifying key demand generators is crucial for understanding the factors driving hotel occupancy and revenue. These generators can include tourism attractions, business centers, convention facilities, and seasonal events. For instance, a hotel near a popular national park may experience peak demand during summer months, while a property in a business district may rely on corporate travel and conferences for consistent occupancy. Analyzing historical occupancy trends and projecting future demand based on anticipated events and economic activity provides valuable insights into revenue potential. This analysis informs investment decisions and allows for the development of targeted marketing campaigns to attract specific customer segments.

- Economic Indicators

Local economic conditions significantly influence the performance of the hospitality sector. Factors such as employment rates, income levels, and business activity directly impact demand for hotel accommodations. A thriving local economy with strong job growth and increasing disposable income typically supports higher hotel occupancy rates and ADR. Conversely, economic downturns can negatively impact travel and tourism, leading to decreased demand and pricing pressures. Monitoring economic indicators and incorporating economic forecasts into market analysis provides a broader context for assessing investment risk and projecting future performance.

- Future Market Trends

Analyzing future market trends allows investors to anticipate changes in demand, competition, and market dynamics. Factors such as projected population growth, infrastructure development, and shifts in tourism patterns can significantly impact the long-term value of a hotel property. For example, a region experiencing rapid population growth may present opportunities for new hotel development or expansion, while a decline in tourism due to changing travel preferences may pose challenges for existing properties. Anticipating these trends enables investors to make proactive adjustments to their investment strategies and position their properties for long-term success. This may involve adapting to changing customer preferences, investing in property renovations to maintain competitiveness, or exploring new market segments to diversify revenue streams.

A comprehensive market analysis, encompassing these facets, provides a crucial foundation for evaluating hotels for sale in Utah. By understanding market dynamics, competitive pressures, demand drivers, and future trends, investors can make informed decisions that maximize the likelihood of financial success in the dynamic Utah hospitality market. This analysis should inform not only the initial acquisition decision but also ongoing operational strategies, marketing efforts, and long-term investment planning. Ignoring these market realities can lead to misinformed investment choices and potentially jeopardize the long-term viability of a hotel property.

5. Legal Due Diligence

Legal due diligence is a critical component of acquiring hotels for sale in Utah. It involves a comprehensive investigation of a property’s legal standing, ensuring compliance with all applicable regulations and identifying potential legal risks. This process protects investors from unforeseen liabilities and facilitates informed decision-making. A thorough legal review encompasses several key areas, including title examination to confirm clear ownership and identify any encumbrances, such as liens or easements. Zoning compliance verification ensures the property’s intended use aligns with local regulations, preventing future operational challenges. Review of permits and licenses confirms the validity of existing operational authorizations, avoiding potential disruptions to business operations. Contractual obligations, including lease agreements, vendor contracts, and employment agreements, are scrutinized for potential liabilities and compliance issues. Environmental assessments identify potential environmental hazards or liabilities associated with the property, safeguarding against future remediation costs or legal disputes. For example, a hotel located near a protected natural area may require additional environmental permits or face restrictions on development. Failure to conduct thorough environmental due diligence could expose the investor to significant financial and legal liabilities. Another example involves verifying compliance with the Americans with Disabilities Act (ADA). Ensuring accessibility features meet regulatory requirements is essential to avoid potential legal challenges and ensure inclusivity for all guests.

Thorough legal due diligence mitigates risks and facilitates a smooth transaction process. Identifying potential legal issues early allows for negotiation of appropriate safeguards or adjustments to the purchase agreement. This proactive approach can prevent costly legal disputes and operational disruptions after the acquisition. For instance, discovering a title defect during due diligence allows for corrective action before the sale is finalized, protecting the investor from future ownership disputes. Similarly, identifying non-compliance with local zoning ordinances enables the buyer to address these issues preemptively, avoiding potential fines or operational restrictions. Furthermore, a comprehensive legal review provides a clear understanding of existing contractual obligations, enabling the new owner to assume these responsibilities seamlessly and avoid breaches of contract. In the case of franchise agreements, legal due diligence ensures compliance with brand standards and operational requirements, safeguarding the franchise relationship and protecting the hotel’s brand reputation.

Legal due diligence is an indispensable aspect of acquiring hotels in Utah. It safeguards investors from potential legal and financial risks, facilitating informed decision-making and contributing to a smooth transaction process. A comprehensive legal review, encompassing all relevant legal and regulatory aspects, ensures compliance, mitigates potential liabilities, and protects the long-term value of the investment. Failure to conduct thorough legal due diligence can have significant financial and legal consequences, jeopardizing the success of the acquisition. By prioritizing legal due diligence, investors can confidently navigate the complexities of the Utah hotel market and make sound investment decisions that align with their long-term financial goals.

6. Operational Efficiency

Operational efficiency significantly impacts the profitability and desirability of hotels for sale in Utah. Potential buyers carefully evaluate existing operational practices, seeking streamlined processes and cost-effective strategies that maximize revenue generation. Analyzing operational efficiency provides crucial insights into a property’s current performance and its potential for future growth. A well-managed, efficient operation often translates to higher profit margins and a stronger market position, making the property more attractive to prospective buyers.

- Staffing and Training

Effective staffing and comprehensive training programs are essential for maintaining high service standards and operational efficiency. Well-trained staff can perform their duties effectively, minimizing errors and maximizing guest satisfaction. Proper staffing levels ensure efficient workflow and minimize labor costs. For example, a hotel with a well-trained front desk staff can efficiently manage check-in and check-out processes, minimizing wait times and enhancing guest experience. Conversely, inadequate staffing or insufficient training can lead to operational bottlenecks, decreased guest satisfaction, and negative impacts on profitability. Potential buyers assess current staffing models and training protocols to identify areas for improvement and estimate potential costs associated with implementing necessary changes.

- Technology and Systems

Leveraging technology and implementing robust management systems are key components of operational efficiency. Property management systems (PMS) streamline reservations, guest services, and back-office operations. Modern PMS platforms integrate various functions, from online booking and revenue management to housekeeping and maintenance tracking. Effective use of technology can automate tasks, reduce manual errors, and optimize resource allocation. For instance, automated check-in/check-out systems can expedite guest processing and reduce front desk workload. Similarly, revenue management software can optimize pricing strategies based on demand and market trends, maximizing revenue generation. Buyers evaluate the existing technology infrastructure and identify potential upgrades or investments needed to enhance operational efficiency and competitiveness.

- Cost Control Measures

Implementing effective cost control measures is essential for maximizing profitability. Analyzing expenses related to utilities, supplies, maintenance, and staffing identifies areas for potential cost reduction without compromising service quality. For example, implementing energy-efficient lighting and HVAC systems can significantly reduce utility expenses. Negotiating favorable contracts with suppliers can lower procurement costs. Optimizing staffing schedules based on occupancy patterns can minimize labor expenses. Potential buyers scrutinize operating expenses to assess the effectiveness of current cost control measures and identify opportunities for further optimization.

- Maintenance and Upkeep

Regular maintenance and proactive upkeep of the property are crucial for preserving its value and ensuring efficient operations. A well-maintained property attracts guests, minimizes repair costs, and prevents operational disruptions. For example, a hotel with a proactive maintenance program can address minor issues before they escalate into costly repairs. Regular inspections and preventative maintenance of HVAC systems, plumbing, and electrical systems ensure efficient operation and minimize the risk of breakdowns. Buyers assess the condition of the property and evaluate the existing maintenance program to identify potential deferred maintenance issues and estimate future capital expenditure requirements.

Operational efficiency is a key determinant of a hotel’s profitability and market value in Utah. Potential buyers carefully evaluate these facets of operations during the due diligence process. A hotel demonstrating strong operational efficiency is more attractive to investors, commanding higher valuations and offering greater potential for long-term financial success. Understanding the interplay of these operational factors provides a comprehensive view of a property’s current performance and future potential within the competitive Utah hospitality market.

7. Growth Potential

Growth potential significantly influences the valuation and desirability of hotels for sale in Utah. This potential represents the capacity for a property to increase its revenue, profitability, and market share over time. Several factors contribute to a hotel’s growth potential, including market dynamics, local economic conditions, tourism trends, and the property’s capacity for expansion or enhancement. A hotel located in a rapidly growing market with increasing tourism demand, for example, exhibits higher growth potential compared to a property in a stagnant or declining market. Similarly, a hotel with opportunities for expansion, such as adding rooms, meeting spaces, or amenities, possesses greater growth potential than a property constrained by physical limitations. For instance, a hotel situated near a newly developed convention center in a growing city like St. George might present significant growth potential due to increased business travel and event-related demand.

Analyzing growth potential requires a comprehensive understanding of market trends and future projections. Factors such as projected population growth, infrastructure development, and anticipated tourism patterns play crucial roles in assessing long-term growth prospects. A region experiencing significant infrastructure investment, such as new highways or airport expansions, may attract increased tourism and business travel, positively impacting hotel demand. Furthermore, shifts in consumer preferences, such as growing demand for eco-tourism or wellness travel, can create opportunities for hotels that cater to these emerging trends. For example, a hotel located near Moab, with opportunities to offer adventure tourism packages, might experience increased demand due to the growing popularity of outdoor recreation. Understanding these trends enables investors to identify properties positioned to capitalize on future market growth.

Evaluating growth potential is essential for informed investment decisions. Properties with strong growth prospects typically command higher valuations and offer greater potential for long-term returns. However, accurately assessing growth potential requires careful analysis of market conditions, competitive dynamics, and property-specific factors. Overestimating growth potential can lead to inflated valuations and disappointing financial outcomes. Conversely, underestimating growth potential may result in missed investment opportunities. Therefore, a thorough assessment of growth potential, combined with realistic financial projections and a comprehensive understanding of market dynamics, is crucial for successful investment in the Utah hotel market. This analysis should be an integral part of the due diligence process, informing investment decisions and shaping long-term ownership strategies.

Frequently Asked Questions

This FAQ section addresses common inquiries regarding hotel acquisitions in Utah, providing concise and informative responses.

Question 1: What factors influence hotel valuations in Utah?

Several factors influence hotel valuations, including location, property type, financial performance (e.g., occupancy rates, average daily rates, and revenue per available room), condition, brand affiliation (if any), and market dynamics.

Question 2: What are the typical due diligence steps involved in a hotel acquisition?

Due diligence typically includes a thorough review of financial records, property inspections, title searches, environmental assessments, and market analyses to assess the property’s financial health, physical condition, legal standing, and market position.

Question 3: What financing options are available for hotel acquisitions in Utah?

Financing options can include traditional bank loans, Small Business Administration (SBA) loans, private equity investments, and seller financing. The optimal financing structure depends on the specific transaction and the buyer’s financial profile.

Question 4: How does the seasonality of Utah’s tourism industry impact hotel investments?

Utah’s tourism industry experiences seasonal fluctuations, with peak seasons typically corresponding to ski season in winter and outdoor recreation opportunities in summer. Investors must consider the impact of seasonality on occupancy rates and revenue projections when evaluating potential acquisitions.

Question 5: What are the key legal and regulatory considerations for hotel operations in Utah?

Key legal and regulatory considerations include compliance with zoning regulations, building codes, licensing requirements for food and beverage service and alcohol sales, and adherence to accessibility standards mandated by the Americans with Disabilities Act (ADA).

Question 6: What resources are available for prospective hotel buyers in Utah?

Resources include commercial real estate brokers specializing in hospitality properties, hospitality consultants, legal counsel experienced in real estate transactions, and industry associations such as the Utah Hotel & Lodging Association.

Thorough research and professional guidance are essential for successful hotel acquisition in Utah. Consulting with experienced professionals in the hospitality industry, legal, and financial sectors is recommended.

For further information, please consult the subsequent sections of this resource or contact relevant industry professionals.

Hotels for Sale Utah

The Utah hospitality market presents a diverse range of acquisition opportunities, encompassing various property types, locations, and investment strategies. Careful consideration of factors such as location advantages, property type distinctions, financial performance indicators, market dynamics, legal due diligence requirements, operational efficiency benchmarks, and growth potential assessments is essential for informed decision-making. Understanding the interplay of these factors provides a comprehensive framework for evaluating potential investments and mitigating risks.

Navigating the complexities of hotel acquisitions in Utah requires thorough research, strategic planning, and expert guidance. Potential investors are encouraged to leverage available resources, including industry professionals, market data, and legal counsel, to make informed decisions aligned with individual investment objectives. The dynamic nature of the Utah hospitality market presents both challenges and opportunities, rewarding those who approach acquisitions with diligence and a comprehensive understanding of market dynamics. Thorough preparation positions investors to capitalize on the potential of this vibrant market and contribute to the ongoing growth of Utah’s tourism and hospitality sector.