Acquiring full ownership of a lodging establishment in the United States involves understanding the market dynamics that influence property valuations. These valuations represent the cost of purchasing not just the building but also the land it occupies, giving the buyer complete control and potential for future development.

This form of property acquisition offers significant long-term investment potential. Owning the land and building outright provides stability, potential for property appreciation, and greater flexibility in management and renovations. Historical trends in the hospitality industry, coupled with economic factors and local market conditions, play a crucial role in determining these valuations. Understanding these trends is essential for informed investment decisions.

The following sections will delve deeper into the factors influencing property values, regional market variations, and investment strategies relevant to this market segment.

Careful consideration of several key factors is crucial for successful investment in full ownership of hotel properties in the United States. The following tips offer guidance for navigating this complex market.

Tip 1: Conduct Thorough Due Diligence: Comprehensive property assessments, including financial records, physical inspections, and environmental reviews, are essential. This helps identify potential risks and informs accurate valuation.

Tip 2: Analyze Market Dynamics: Understanding local market conditions, including occupancy rates, average daily rates, and competitor analysis, is crucial for projecting future performance and revenue potential.

Tip 3: Secure Expert Legal Counsel: Experienced legal professionals specializing in real estate and hospitality transactions are essential for navigating complex legal frameworks and ensuring a smooth transaction process.

Tip 4: Evaluate Financing Options: Exploring various financing options and securing favorable loan terms is critical for managing investment costs and maximizing returns.

Tip 5: Consider Long-Term Investment Horizons: Full ownership of hospitality properties typically represents a significant long-term investment. Patience and a strategic approach are essential for realizing the full potential of these assets.

Tip 6: Assess Management Expertise: Effective property management plays a vital role in operational efficiency and profitability. Evaluating existing management or securing qualified professionals is crucial.

Tip 7: Factor in Renovation and Capital Expenditure Needs: Allocating resources for potential renovations, upgrades, and ongoing maintenance is essential for preserving property value and ensuring long-term competitiveness.

By carefully considering these factors, potential investors can make informed decisions and mitigate risks associated with acquiring full ownership of hotel properties in the United States.

The insights provided in this section offer a practical guide for navigating the complexities of this investment landscape. The concluding section will summarize key takeaways and offer final recommendations for prospective investors.

1. Location

Location plays a critical role in determining American hotel freehold prices. The desirability and profitability of a hotel are deeply intertwined with its geographic placement. Understanding the influence of location allows for informed investment decisions and accurate property valuations.

- Urban vs. Rural Settings

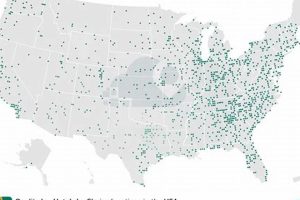

Urban locations, particularly in major cities or tourist destinations, often command higher freehold prices due to increased demand, limited supply, and higher potential revenue streams. Conversely, rural properties may offer lower acquisition costs but face challenges attracting consistent demand and achieving comparable profitability. A hotel in downtown Manhattan will likely have a significantly higher freehold price than a comparable property in rural Wyoming.

- Proximity to Demand Generators

Hotels near major attractions, business districts, convention centers, or transportation hubs benefit from consistent demand drivers. This proximity translates to higher occupancy rates and premium pricing, impacting freehold values. A hotel near Disney World in Orlando will likely have a higher freehold price than a similar hotel further away.

- Local Market Conditions

Economic conditions, tourism trends, and local competition within a specific market influence freehold prices. A thriving local economy with high tourism activity will generally support higher property values. For example, a hotel in a booming tech hub might experience greater demand and higher prices than a similar hotel in a region experiencing economic downturn.

- Accessibility and Infrastructure

Easy access to transportation networks, utilities, and other essential infrastructure contributes to a property’s value. Well-maintained roads, reliable public transport, and access to utilities enhance operational efficiency and guest convenience, influencing freehold prices. A hotel with convenient access to a major highway will likely be more valuable than a comparable property with limited access.

By analyzing these facets of location, investors can gain a comprehensive understanding of their impact on American hotel freehold prices. A thorough assessment of location-specific factors is crucial for making informed investment decisions and accurately evaluating potential returns.

2. Property Type

Property type significantly influences American hotel freehold prices. Different categories of lodging establishments cater to distinct market segments, impacting demand, operating costs, and ultimately, valuations. Understanding these distinctions is crucial for assessing investment potential.

Luxury hotels, often featuring high-end amenities, personalized services, and prime locations, command premium prices. The exclusivity and high operating costs associated with these properties contribute to elevated freehold valuations. For example, a five-star beachfront resort in Miami will likely have a significantly higher freehold price than a budget motel in a less desirable location. Boutique hotels, characterized by unique design and personalized experiences, also occupy a distinct market segment. Their freehold prices often reflect the value proposition of their specialized offerings.

Mid-scale hotels, catering to a broader market segment, offer a balance between price and amenities. Their freehold prices typically reflect their accessibility and moderate operating costs. Economy hotels and motels, focusing on essential accommodations at competitive rates, represent the lower end of the price spectrum. Their freehold values are often influenced by factors such as location, occupancy rates, and operating efficiencies. Extended-stay hotels, designed for longer-term guests, represent another distinct category. Their freehold prices reflect demand from business travelers and relocating individuals, often influenced by proximity to business centers and transportation hubs.

The relationship between property type and freehold prices is complex and multifaceted. Analyzing factors like target demographics, operating expenses, revenue potential, and market positioning provides a more comprehensive understanding of how property type influences valuations. This understanding is essential for making informed investment decisions in the American hotel market.

3. Market Conditions

Market conditions exert a significant influence on American hotel freehold prices. Fluctuations in supply and demand, economic trends, and local market dynamics directly impact property valuations. Understanding these interconnected factors is crucial for assessing investment opportunities and making informed decisions in the hospitality sector.

- Supply and Demand Dynamics

The balance between the number of available hotel rooms and the demand for accommodations plays a pivotal role in determining freehold prices. In markets with high demand and limited supply, property values tend to increase. Conversely, an oversupply of rooms can depress prices. For instance, a surge in tourism in a coastal city with limited hotel development could drive up freehold prices, while a decline in business travel to a specific region could lead to lower valuations due to reduced demand.

- Economic Climate

The overall economic climate, including factors like GDP growth, interest rates, and employment levels, significantly impacts the hospitality industry. A strong economy generally fosters increased travel and higher hotel occupancy, positively influencing freehold prices. Conversely, economic downturns can lead to decreased travel and lower valuations. For example, a period of economic expansion could drive up demand for business travel and leisure tourism, leading to higher hotel occupancy and increased freehold prices, while a recession could have the opposite effect.

- Local Market Dynamics

Local market conditions, such as tourism trends, seasonal fluctuations, and major events, can significantly impact freehold prices. A city hosting a major international event might experience a temporary surge in demand, leading to increased hotel rates and potentially higher property valuations. Similarly, seasonal variations in tourism can create fluctuations in demand and prices. A ski resort town, for example, may see higher freehold prices during peak ski season compared to the off-season.

- Competition and Market Share

The level of competition within a specific market and a hotel’s market share also influence freehold prices. A market saturated with similar hotels may experience downward pressure on prices due to increased competition. Conversely, a hotel with a strong market share and a differentiated offering may command a premium price. For example, a newly built luxury hotel in a market dominated by older properties could command a higher freehold price due to its competitive advantage.

By carefully analyzing these market conditions, investors can gain a deeper understanding of their influence on American hotel freehold prices. Recognizing the interplay of these factors provides valuable insights for assessing investment risks and opportunities within the dynamic hospitality landscape. Overlooking these factors can lead to inaccurate valuations and potentially unfavorable investment outcomes.

4. Financial Performance

Financial performance serves as a cornerstone in determining American hotel freehold prices. A hotel’s historical and projected financial health directly influences its market value, playing a crucial role in investment decisions. Key performance indicators (KPIs) such as revenue per available room (RevPAR), occupancy rates, average daily rate (ADR), and operating expenses provide critical insights into a property’s profitability and potential for future growth. A hotel demonstrating strong and consistent financial performance will typically command a higher freehold price compared to a property with weaker financials. For example, a hotel with consistently high RevPAR and occupancy rates, coupled with well-managed operating expenses, will be more attractive to investors and likely achieve a higher valuation. Conversely, a hotel struggling with low occupancy, declining ADR, and escalating expenses will likely face lower valuations. Understanding this direct correlation between financial performance and freehold prices is fundamental for both buyers and sellers in the hospitality market.

Analyzing financial statements, including income statements, balance sheets, and cash flow statements, provides crucial insights into a hotel’s operational efficiency and profitability. Evaluating trends in revenue generation, cost management, and debt levels allows investors to assess the underlying financial health of a property. Furthermore, projecting future financial performance based on market trends, anticipated capital expenditures, and management strategies is essential for determining a property’s long-term investment potential. For instance, a hotel undergoing renovations and expansion may experience short-term declines in financial performance but project significant growth in the long term, impacting its freehold price accordingly. Due diligence in assessing both historical and projected financial performance is paramount for making informed investment decisions and accurate valuations.

In summary, financial performance is inextricably linked to American hotel freehold prices. A rigorous analysis of key performance indicators, financial statements, and future projections provides essential insights into a property’s value and investment potential. This understanding is crucial for navigating the complexities of the hospitality market and making sound investment decisions. Overlooking the importance of financial performance can lead to misaligned valuations and potentially unfavorable investment outcomes. The ability to accurately assess and interpret financial data is therefore paramount for successful investment in the American hotel market.

5. Brand Affiliation

Brand affiliation exerts a substantial influence on American hotel freehold prices. A hotel’s association with a recognized brand introduces a layer of complexity to property valuations, impacting investor perception, market positioning, and ultimately, pricing. Established brands often bring several advantages, including enhanced customer loyalty, access to global reservation systems, marketing support, and standardized quality assurance. These factors contribute to increased revenue potential and perceived lower risk, often translating to higher freehold prices compared to independent properties. For example, a Holiday Inn Express, benefiting from brand recognition and established customer loyalty, may command a higher freehold price than an independent motel offering similar amenities in the same location. This premium reflects the perceived value and reduced risk associated with brand affiliation. Conversely, properties operating under less-recognized or struggling brands might experience downward pressure on freehold prices. The brand’s reputation and market performance directly impact investor confidence and property valuations.

The strength and reputation of the brand play a crucial role in determining the magnitude of this impact. Internationally recognized luxury brands, such as Four Seasons or Ritz-Carlton, often command significant price premiums, reflecting the prestige, exclusivity, and high service standards associated with these brands. These brands attract a specific clientele willing to pay premium prices for the associated experience, driving up both revenue and freehold values. Similarly, well-established mid-scale brands, such as Hampton Inn or Courtyard by Marriott, benefit from broad market appeal and consistent quality, positively impacting freehold prices. However, it’s essential to recognize that brand affiliation alone does not guarantee higher valuations. Factors such as market conditions, property location, and the specific terms of the franchise agreement also influence freehold prices. A poorly performing hotel, even under a recognized brand, may not achieve the same valuation as a thriving independent property in a prime location.

Understanding the complex interplay between brand affiliation and freehold prices requires a nuanced approach, considering both the tangible and intangible benefits associated with brand association. While brand recognition and established operational systems contribute to higher valuations, factors such as franchise fees, brand standards compliance requirements, and the brand’s overall market performance also warrant careful consideration. A comprehensive analysis of these factors is essential for accurately assessing the impact of brand affiliation on American hotel freehold prices and making informed investment decisions. Overlooking these nuances can lead to misaligned valuation expectations and potentially unfavorable investment outcomes. Therefore, due diligence in evaluating both the brand and the specific property is paramount for navigating the complexities of the hospitality market and maximizing investment returns.

Frequently Asked Questions

This section addresses common inquiries regarding freehold prices for hotel properties in the United States. Clear and concise answers provide valuable insights for potential investors and stakeholders.

Question 1: What key factors influence freehold hotel prices in the U.S.?

Location, property type, brand affiliation, financial performance, and prevailing market conditions are primary determinants of freehold prices. Urban locations, luxury properties, and strong brands often command premium valuations. A property’s financial health and prevailing market dynamics also significantly influence pricing.

Question 2: How do market conditions impact hotel valuations?

Economic fluctuations, supply and demand dynamics, local tourism trends, and interest rates all play a role. A thriving economy and limited supply tend to increase prices, while economic downturns and oversupply can depress valuations.

Question 3: What is the significance of due diligence in assessing freehold prices?

Thorough due diligence is critical. It involves comprehensive property assessments, financial analysis, legal reviews, and market research to ensure accurate valuations and identify potential risks.

Question 4: How does brand affiliation affect a hotel’s freehold price?

Affiliation with a reputable brand often enhances a property’s value due to brand recognition, customer loyalty, and established operational systems. However, the specific brand’s performance and associated fees also require careful consideration.

Question 5: What are the typical financing options for acquiring freehold hotel properties?

Traditional bank loans, private equity investments, real estate investment trusts (REITs), and joint ventures are common financing options. The most suitable option depends on the investor’s financial situation and investment strategy.

Question 6: What long-term considerations are important for freehold hotel investments?

Long-term investment horizons are typical for freehold hotel properties. Factors such as potential appreciation, ongoing maintenance and renovation costs, and long-term market projections should be considered.

Understanding these key aspects provides a foundation for navigating the complexities of freehold hotel valuations in the United States. Thorough research and professional guidance are crucial for successful investment decisions.

For further insights, the following section delves into specific case studies illustrating the principles discussed above.

American Hotel Freehold Prices

Navigating the landscape of American hotel freehold prices requires a comprehensive understanding of interconnected factors. Location, property type, brand affiliation, market conditions, and financial performance each play a crucial role in determining valuations. Thorough due diligence, encompassing detailed property assessments, market analysis, and financial projections, is essential for informed decision-making. The hospitality market’s dynamic nature necessitates careful consideration of both current and projected market trends, economic indicators, and local market dynamics.

Acquiring freehold hotel properties in the United States represents a significant investment with long-term implications. Strategic planning, rigorous analysis, and expert guidance are crucial for mitigating risks and maximizing potential returns. The insights presented herein provide a framework for understanding the complexities of this market segment. Prudent investors will prioritize comprehensive research and seek expert counsel to navigate the intricacies of American hotel freehold prices and achieve successful investment outcomes.